How to Sell a Financed Phone: What You Need to Know

60-Second Summary

Technically, yes, you can sell your phone while you’re still financing it, but keep in mind, you would be 100% liable for all future payments. Phone financing contracts remain in effect whether you keep the device or sell it, and missed payments would lead to the phone being blacklisted so it would not be usable by the buyer.

Sell Safest Strategy: Pay Off First

The best option if you want to sell a financed phone is to pay it off before listing:

- Call your carrier to find out what the payoff amount is

- Pay the balance off and get written confirmation that the account is paid in full

- Confirm that the device is unlocked before you post your listing

- or Sell Your Cell Phone with BankMyCell when you are in any sort of phone financing status.

Guidelines for Selling Your Financed Phone

If you really have to sell your phone without paying off the balance, then these are the steps to selling a financed phone responsibly:

- Inform the buyer in writing that the phone is financed, payments will continue and liability for missed payments is transferred to the buyer.

- Get the signed written agreement in a physical format, preferably witnessed by a third party.

- Continue making payments until the device is paid off. You are still legally responsible if the buyer stops paying.

- Factor in escrow services for high-value sales to ensure funds are secure.

Alternatives Worth Considering

- Phone carrier trade in programs – They usually waive the remaining balance owed.

- Sell your phone to the carrier – Carrier buybacks and payment processing directly through the carrier.

- Wait to sell until you have fully paid off your device – Completely avoids all of the above issues.

Disclaimer: Selling and stopping payments is illegal and could lead to lawsuits, collection agencies after you, and bad credit. It is ethically dishonest and leaves the buyer with a useless device.

Bottom Line: Only sell your phone after you have paid it off or if you plan on continuing the payments to your carrier. A phone trade in with your carrier usually gives you more value.

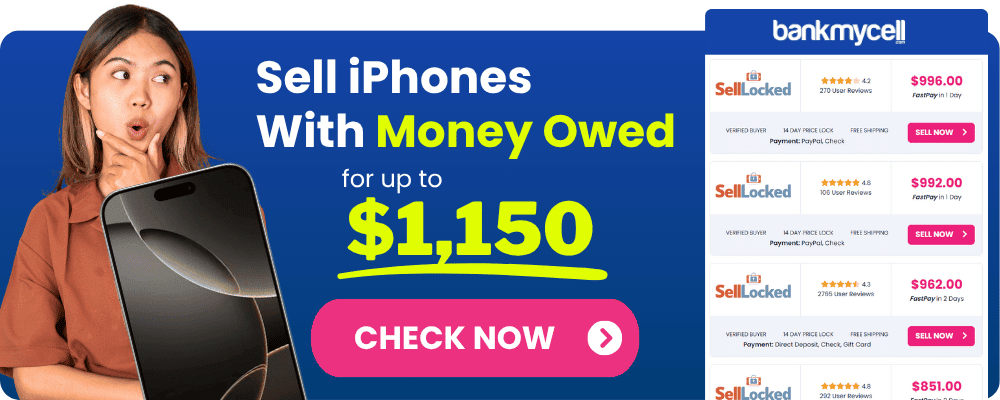

Running low on funds now but think you’ll be stuck making payments on your phone? BankMyCell buys phones in any payment or financing plan stage, you’re just provided with a large upfront cash offer so there’s no chance of getting stuck with monthly obligations. Review competitive offers from trusted buyers with a complete money-back guarantee, seamless escrow security, and fast, transparent shipping procedures—see why it’s an easy, no-complication way to sell your financed phone.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

| TODAY'S BEST iPHONE BUYBACK OFFERS | |||

|---|---|---|---|

| Device | Financed | ||

| iPhone 17 Pro Max | $1460.00 | Compare | |

| iPhone 17 Pro | $1070.00 | Compare | |

| iPhone 17 | $680.00 | Compare | |

| iPhone Air | $640.00 | Compare | |

| iPhone 16e | $410.00 | Compare | |

| iPhone 16 Pro Max | $1095.00 | Compare | |

| iPhone 16 Pro | $920.00 | Compare | |

| iPhone 16 Plus | $610.00 | Compare | |

| iPhone 16 | $475.00 | Compare | |

| iPhone 15 Pro Max | $780.00 | Compare | |

| iPhone 15 Pro | $700.00 | Compare | |

| iPhone 15 Plus | $385.00 | Compare | |

| iPhone 15 | $395.00 | Compare | |

| iPhone 14 Pro Max | $620.00 | Compare | |

| iPhone 14 Pro | $450.00 | Compare | |

| iPhone 14 Plus | $315.00 | Compare | |

| iPhone 14 | $285.00 | Compare | |

| iPhone 13 Pro Max | $330.00 | Compare | |

| iPhone 13 Pro | $270.00 | Compare | |

| iPhone 13 Mini | $155.00 | Compare | |

| iPhone 13 | $165.00 | Compare | |

| iPhone 12 Pro Max | $220.00 | Compare | |

| iPhone 12 Pro | $160.00 | Compare | |

| iPhone 12 Mini | $135.00 | Compare | |

| iPhone 12 | $135.00 | Compare | |

| iPhone 11 Pro Max | $175.00 | Compare | |

| iPhone 11 Pro | $195.00 | Compare | |

| iPhone 11 | $130.00 | Compare | |

| * Best market prices updated February 19th 2026 | |||

Data Source: BankMyCell compares over 100,000+ quotes and customer reviews from 20+ trusted buyback stores every 15 minutes via our data feeds, making us America’s #1 time-saving trade-in supermarket.

Do you want to sell your iPhone or mobile device when you still owe monthly payments?

The sale of a financed phone that hasn’t been completely paid off can appear to be a quick method for obtaining cash or upgrading to a newer device. Before you decide to sell your financed mobile device you must first understand the various legal, financial, and ethical issues involved in the process.

Here’s the problem:

Selling a phone that you’re paying off through financing contracts means you’re selling an asset that you don’t have complete ownership of because the payments are funded by carriers. The sale of your financed device introduces possible challenges that affect both you and prospective buyers.

And that’s not all…

The service provider may blacklist the device if monthly payments are not made, which prevents the new owner from using it.

When you sell a phone that you financed with a carrier you need to understand the legal obligations involved.

You enter legally binding financing agreements when you buy a phone using a carrier financing plan. The financing agreement continues to be valid whether you retain or sell the phone. Carriers mandate monthly fulfillment of contractual obligations as a standard requirement.

This means

- You remain responsible for paying all remaining balances on the device.

- Failing to pay your monthly bills can damage your credit rating and result in the debt being classified as unsecured credit.

- If you stop making payments, the carrier can blacklist your device

- You might receive legal consequences for breaking your contract terms.

Think about it:

Once you sell your financed phone but cease payment obligations, the new owner receives a device that might become non-functional on cellular networks. The situation generates legal problems for the seller while also producing ethical dilemmas related to the Telephone Consumer Protection Act.

You can legally sell a phone with outstanding payments provided you keep up with your payment obligations until the balance clears. Sellers face problems when they discontinue payments after a device sale, which creates opportunities for fraudulent behavior.

You want to sell your phone but are concerned about how to handle remaining payment commitments. BankMyCell provides competitive pricing options for phones across multiple payment situations.

Preparing Your Financed Phone for Sale

When you choose to sell your phone that still has payments due, follow these steps to complete the transaction successfully.

Consider Paying Off the Remaining Balance First

The best approach to prepare your device for sale involves paying off the full balance before transferring ownership. Verizon provides this service alongside several other carriers.

How to do it:

- Reach out to your service provider in order to obtain the total payoff amount.

- You have the option to settle the remaining balance through a single payment or twelve installments.

- Get proof that the device payment has been fully settled

- Verify the device is unlocked before you list it for sale.

The initial financial outlay required through this approach removes complications and permits device sale without attached responsibilities.

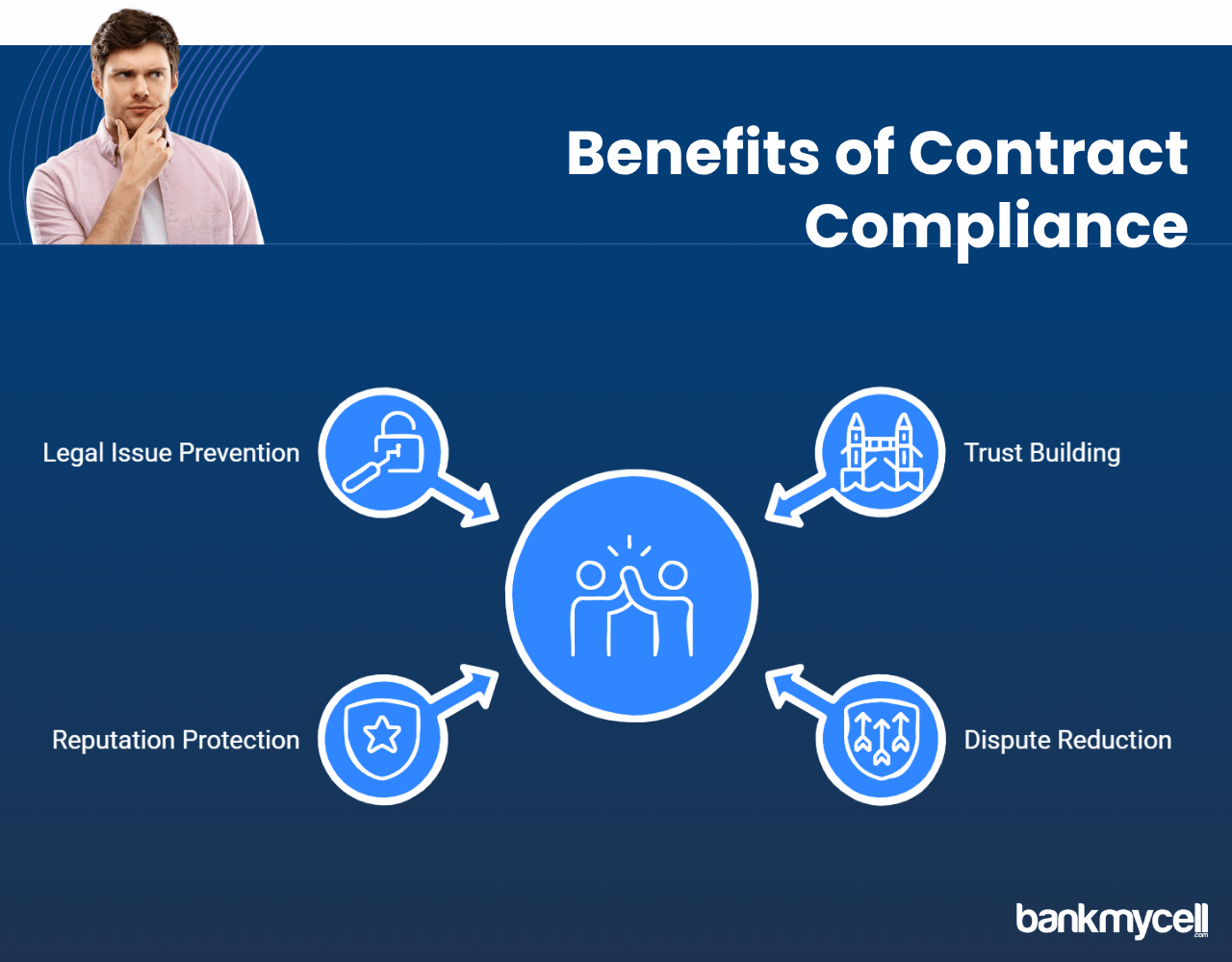

Be Transparent With Potential Buyers

Selling a financed phone requires ethical behavior through complete openness about the phone’s financial status to potential buyers.

The advantage of this approach:

- Builds trust with the buyer

- Reduces the risk of future disputes

- Protects your reputation as a seller

- May prevent legal issues down the road

Make sure the buyer understands that the phone remains under financing while reassuring them of your commitment to pay off the remaining balance. Writing this information down protects both parties and helps maintain a smooth transaction process.

Verify your legal ownership of the device before listing it for sale.

Before selling your device, you should confirm there are no selling restrictions in your financing agreements, even though you don’t own the phone outright until full payment is completed.

Certain carrier agreements prohibit selling devices that are financed, while other agreements permit sales under specific requirements. The policies of T-Mobile and other carriers may vary between companies.

Ready to upgrade to a newer device? BankMyCell ensures maximum resale value for your current phone, whether it is fully paid or still under financing terms.

Alternatives to Selling a Financed Phone

Evaluate alternative options before selling your financed phone because they might be safer and more beneficial.

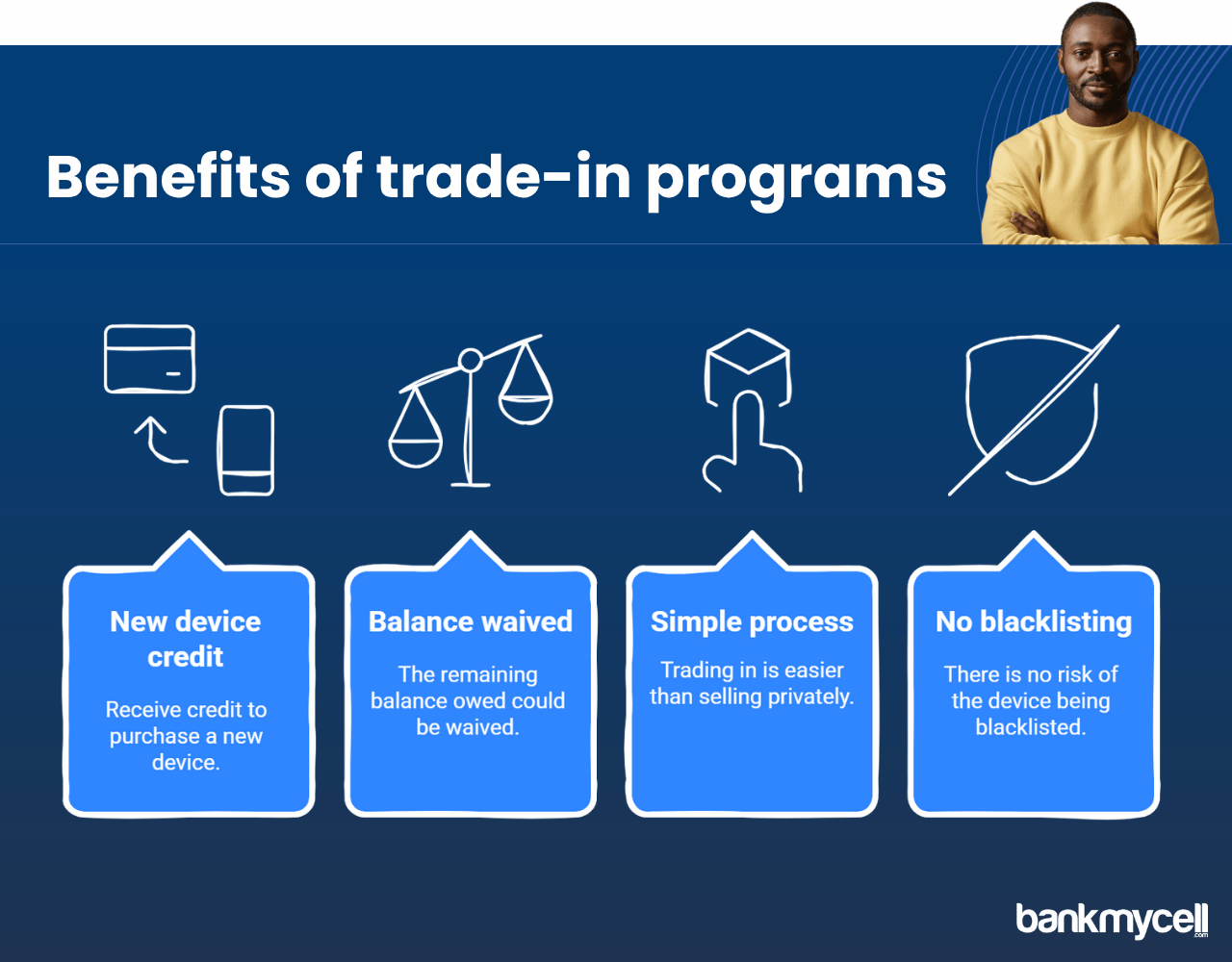

Trade-In Programs for Your Mobile Device

Carriers provide specific trade-in programs for customers who wish to upgrade their devices before completing their payments.

These programs typically offer:

- Credit toward a new device

- The possibility of having remaining balance waived

- A simpler process than selling privately

- No risk of the device being blacklisted

Your service provider can provide details on their trade-in and early upgrade programs which typically offer a direct route to purchase a new phone while eliminating payment concerns for your existing device.

Carrier Buyback Options

Carriers provide buyback programs that allow them to buy your existing device and credit the amount to your account balance or to the purchase of a similar device.

The advantage of this method:

- The carrier directly processes the transaction.

- Your payment obligation can be settled as you complete the transaction.

- Less complicated than private selling

- Often includes proper transfer of liability

You will find this option appealing when you want to keep your existing service provider while transitioning to a new device.

Wait Until It's Fully Paid

The optimal choice often involves waiting until you have completely paid off your phone before selling it.

This strategy doesn’t deliver immediate satisfaction but eliminates possible issues and could produce a better resale value depending on market timing. Many customers find this the safest approach.

Facing issues with your financed phone? BankMyCell provides a service that accepts cell phones in different states of use to help buyers move to their next smartphone.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

Best Practices for Selling a Financed Phone

When you choose to sell your financed device you should adhere to these best practices to ensure protection for both yourself and the buyer.

Document Everything for a Smooth Transaction

Create a written agreement that outlines:

- The present payment standing of the device alongside its outstanding balance

- Your commitment to continue making payments

- Record the unique IMEI or serial number of the phone in the transaction documentation

- Signatures from both parties

Documentation ensures protection for all parties while establishing a transparent record of both the transaction and agreement terms. Consider storing this documentation as a reference for future needs.

Keep Making Monthly Payments

But here’s the truth:

To sell a financed phone in an ethical manner you must keep making payments until you pay off the device completely.

Blocking or blacklisting by the carrier will occur if you cease payments which will prevent cellular service use on the device. This can lead to:

- Disputes with the buyer

- Potential legal action against you

- Damage to your credit score

- Difficulty financing future purchases

Consider an Escrow Service

An escrow service offers both parties improved security when dealing with expensive devices.

The escrow service retains the buyer’s funds until it confirms that all agreed-upon payments have been made according to the terms.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

Helpful FAQ's

Selling a financed phone is not inherently unlawful as long as payment obligations continue to be met.

Selling a financed phone remains legal as long as you fulfill the agreed payment plan. A transaction can break FCC rules if you sell a financed device while deliberately failing to make agreed payments afterwards.

A financed phone will not receive a blacklist status if payments remain current after its sale.

A phone that has financing will be blacklisted only when account payments are discontinued. Providing you continue making the agreed-upon payments until the phone is paid off completely you can sell the phone without risking it being blocked or blacklisted.

Unlocking a financed phone for sale depends on your carrier's specific policies.

Your ability to unlock a financed phone is determined by the specific policies of your carrier. Different carriers require full payment for device unlocking while others allow unlocking after the device has been actively serviced for a specific period regardless of payment status. A toll-free number exists through which you can obtain detailed information.

If I sell my financed phone but fail to continue making payments I risk having the phone blacklisted by the carrier.

The carrier has the authority to blacklist your financed phone if you default on payments after selling it which prevents the device from accessing cellular networks. The buyer may contest the transaction while your credit score suffers damage and you face legal complications from consumer protection regulations.

Am I allowed to pass the financing agreement to the person who buys my phone?

Most financing agreements include terms that prevent them from being transferred to a different person. The original financing agreement stays your responsibility after you sell the device. Assumption of liability programs exist from some carriers but they mandate the buyer to undergo credit evaluation before formally assuming account responsibility.

Wrapping It Up

It is possible to sell a financed phone but doing so requires careful attention to responsibilities and risks. Responsible navigation of this process requires understanding legal implications and proper preparation alongside alternative considerations and best practice adherence.

These essential points should guide you when you are learning to sell a financed phone.

- The legal responsibility for the financing agreements continues to be yours.

- Transparency with potential buyers is essential

- Carrier-specific trade-in programs often provide better alternatives

- Documentation protects both parties

- Regular monthly payments are essential to avoid having the device blacklisted.

A fair sale of a financed phone allows you to upgrade your device while maintaining responsible and ethical practices toward the buyer.