What Happens if You Sell a Phone That's Not Paid Off: Consequences of Selling a Financed iPhone

60-Second Summary

Myth: I can sell a phone with remaining payments for the full price.

Fact: Selling a financed phone before the full balance is paid has very real consequences for both the seller and buyer. Credit score damage, technical functionality issues, and legal liability are serious risks.

Financial Consequences

1. Monthly payments still due

- Financed monthly payments do not stop because the phone changes owners—you remain legally responsible for the remaining balance

- Predictable collections and 50-100+ credit score point drops on missed payments

- Late fees and additional charges will accrue on your payment plan

2. Technical retaliation by carrier

- Carrier can blacklist the phone based on IMEI number, blocking its use on cellular networks

- Device becomes WiFi-only, essentially an expensive iPod

- Carrier has technical means to remotely lock a device so a factory reset will not restore functionality

3. Legal Liability/li> on buyer for misuse

- Seller faces breach of contract violations and lawsuits for the remaining balance and damages

- Potential fraud charges if phone payment status was misrepresented

- Buyer can take legal action against the seller when the device is rendered unusable

Alternatives to Selling a Financed Phone

Best Practices:

- Pay off the remaining balance first

- Use the official trade-in program

- Transfer the responsibility

- Complete transparency

- If selling, require a written agreement from the buyer acknowledging the payment status. (not liable for buyer’s legal action against the seller for breach of agreement

BOTTOM LINE: Selling a financed iPhone before the full balance is paid off is never worth the hassle and potential liability. The consequences financially, legally, and technically far outweigh the benefit of the short-term cash. Stick to official trade-in programs or paying off the device completely before selling it.

Alternative Solution: Need to upgrade but still paying off your current phone? BankMyCell has transparent buyback options that will help you navigate responsibly upgrading even when the phone you currently have is financed. Compare top trade-in values from vetted and reliable shops that provide clear guidance on the payment status requirements before selling. This is an easy way to avoid the legal and financial pitfalls of selling a phone with payments still owed.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

| TODAY'S BEST iPHONE BUYBACK OFFERS | |||

|---|---|---|---|

| Device | Financed | ||

| iPhone 17 Pro Max | $1460.00 | Compare | |

| iPhone 17 Pro | $1070.00 | Compare | |

| iPhone 17 | $680.00 | Compare | |

| iPhone Air | $640.00 | Compare | |

| iPhone 16e | $410.00 | Compare | |

| iPhone 16 Pro Max | $1095.00 | Compare | |

| iPhone 16 Pro | $920.00 | Compare | |

| iPhone 16 Plus | $610.00 | Compare | |

| iPhone 16 | $475.00 | Compare | |

| iPhone 15 Pro Max | $780.00 | Compare | |

| iPhone 15 Pro | $700.00 | Compare | |

| iPhone 15 Plus | $385.00 | Compare | |

| iPhone 15 | $395.00 | Compare | |

| iPhone 14 Pro Max | $620.00 | Compare | |

| iPhone 14 Pro | $450.00 | Compare | |

| iPhone 14 Plus | $315.00 | Compare | |

| iPhone 14 | $285.00 | Compare | |

| iPhone 13 Pro Max | $330.00 | Compare | |

| iPhone 13 Pro | $270.00 | Compare | |

| iPhone 13 Mini | $155.00 | Compare | |

| iPhone 13 | $165.00 | Compare | |

| iPhone 12 Pro Max | $220.00 | Compare | |

| iPhone 12 Pro | $160.00 | Compare | |

| iPhone 12 Mini | $135.00 | Compare | |

| iPhone 12 | $135.00 | Compare | |

| iPhone 11 Pro Max | $175.00 | Compare | |

| iPhone 11 Pro | $195.00 | Compare | |

| iPhone 11 | $130.00 | Compare | |

| * Best market prices updated February 19th 2026 | |||

Data Source: BankMyCell compares over 100,000+ quotes and customer reviews from 20+ trusted buyback stores every 15 minutes via our data feeds, making us America’s #1 time-saving trade-in supermarket.

Ever wondered what happens if you sell a phone that’s not paid off yet?

Selling your iPhone before it’s fully paid can seem like an attractive option when you need quick cash or want to upgrade to a new phone early. However, this seemingly simple transaction involving a financed phone comes with significant potential consequences that many sellers don’t realize until it’s too late.

Here’s the problem:

When you sell a financed phone that’s still under contract, you’re essentially transferring possession of both the device and your payment plan obligations. Your carrier or service provider still has a legal claim to that device until the remaining balance is paid in full.

And that’s not all…

The consequences can affect your credit score, legal standing, and even impact the innocent buyer who purchases your device.

Financial Consequences of Selling a Financed Phone: What Happens if You Sell a Phone That's Not Paid Off

When you purchase an iPhone through a carrier financing plan or installment agreement with your service provider, you’re entering into a legally binding phone contract. Understanding the financial ramifications of breaking this financing agreement before your contract expires is crucial.

You're Still Responsible for Monthly Payments

Selling your financed phone doesn’t eliminate your financial obligation to the carrier or financing company. This is a common misconception that leads many people into trouble when they sell a phone they still owe money on.

This means:

- You must continue making payments until the phone is fully paid off

- The full remaining balance may become due immediately if you violate the contract terms

- Missing payments will result in late fees and additional charges on your payment plan

If you stop making payments, the carrier will likely send your account to collections after a certain period (typically 30-90 days of missed payments). Once your account reaches collections, you’ll face aggressive collection attempts and potentially legal action for the remaining balance.

Impact on Your Credit Score

One of the most significant long-term consequences of defaulting on your phone payment agreement is damage to your credit score.

Think about it:

A credit score impact from a defaulted phone contract can affect your ability to get approved for loans, credit cards, apartments, and even some jobs for years to come.

Here’s how your credit can be damaged:

- Late payments reported to credit bureaus (typically after 30 days late)

- Collections accounts (which can remain on your credit for 7 years)

- Potential civil judgments if the carrier takes legal action

- Increased difficulty obtaining financing in the future

According to financial experts, a collections account from a defaulted phone contract can drop your credit score by 50-100 points or more, depending on your credit history.

Ready to upgrade but still paying off your current phone? BankMyCell offers transparent comparison of buyback options that may help you navigate upgrading responsibly, even with a financed device.

Technical Consequences for the Phone

Beyond the financial impact to you, selling a financed phone can lead to technical consequences that affect the device itself and its new owner.

Blacklisting and IMEI Blocking

When payments stop on a financed iPhone, carriers have the technical ability to render the device unusable on their network—and often on other networks as well.

Here’s how blacklisting works:

- The carrier flags the phone’s unique IMEI (International Mobile Equipment Identity) number in a shared database

- Once blacklisted, the device cannot connect to most cellular networks

- The phone essentially becomes limited to WiFi functionality only

- This process can happen automatically after several missed payments

The most troubling aspect is that this can happen months after you’ve sold the phone, leaving the buyer with an expensive device that suddenly stops working.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

Remote Locking and Management

Modern carrier agreements often include provisions allowing remote management of financed devices. This means:

- Some carriers can remotely lock or disable devices when payments stop

- Features may be restricted until the account is brought current

- Factory resets won’t remove these restrictions since they’re tied to the IMEI

These technological enforcement mechanisms ensure that selling a financed phone doesn’t eliminate the leverage the carrier has over the device itself.

Legal Consequences You May Face

Selling a financed iPhone doesn’t just have financial and technical implications—it can also lead to serious legal issues.

Breach of Contract

When you sign a financing agreement with a carrier or financing company, you’re agreeing to specific terms that typically prohibit selling the device before it’s paid off.

This means:

- Selling the phone likely violates your contract terms

- The carrier may pursue legal action for breach of contract

- You could be sued for the remaining balance, plus damages and legal fees

Most financing agreements specifically state that you do not have the right to sell or transfer the device until it’s fully paid for, making the sale a direct violation of your legal obligations.

Potential Fraud Charges

In more severe cases, particularly if you misrepresented the phone as fully paid off to the buyer, you could face fraud charges.

Potentially fraudulent behavior includes:

- Claiming you own the phone outright when it’s still financed

- Selling a phone knowing it will be blacklisted

- Providing false documentation about the phone’s payment status

While minor cases might only result in civil penalties, intentional fraud can lead to criminal charges in extreme situations, especially if it’s part of a larger pattern or scheme.

Lawsuits from the Buyer

When the person who bought your financed iPhone discovers it’s been blacklisted or is otherwise unusable, they have legal grounds to pursue action against you.

Buyer legal remedies may include:

- Small claims court for the purchase price plus damages

- Reports to consumer protection agencies

- In some cases, criminal fraud complaints

The legal principle of “implied warranty of title” means that when you sell something, you’re implicitly guaranteeing that you have the right to sell it. Since a financed phone isn’t fully yours to sell, you’re potentially violating this warranty.

Need guidance on legal options for your financed phone? BankMyCell offers resources and options for those looking to responsibly handle financed devices without negative consequences.

Consequences for the Buyer

It’s not just you who suffers when a financed phone is sold—the buyer often ends up with the worst outcome of all.

Unusable Device After Blacklisting

The most immediate consequence for buyers is ending up with a phone that suddenly stops working on cellular networks.

This means:

- The phone can only connect to WiFi, essentially becoming an expensive iPod

- They cannot transfer the service to the device

- The device has significantly reduced functionality and value

- They’ve potentially lost hundreds of dollars

Many buyers don’t discover this problem immediately. The phone may work fine for weeks or months before the blacklisting occurs, making it difficult to track down the seller for recourse.

No Warranty or Support

Buyers of blacklisted or financed phones often discover they have limited options for support:

- Apple and carriers may refuse service on blacklisted devices

- Warranty claims may be denied due to payment status

- The buyer has limited recourse except to pursue the seller

For the buyer, this situation creates significant frustration and financial loss, all stemming from a decision you made to sell a phone that wasn’t fully paid off.

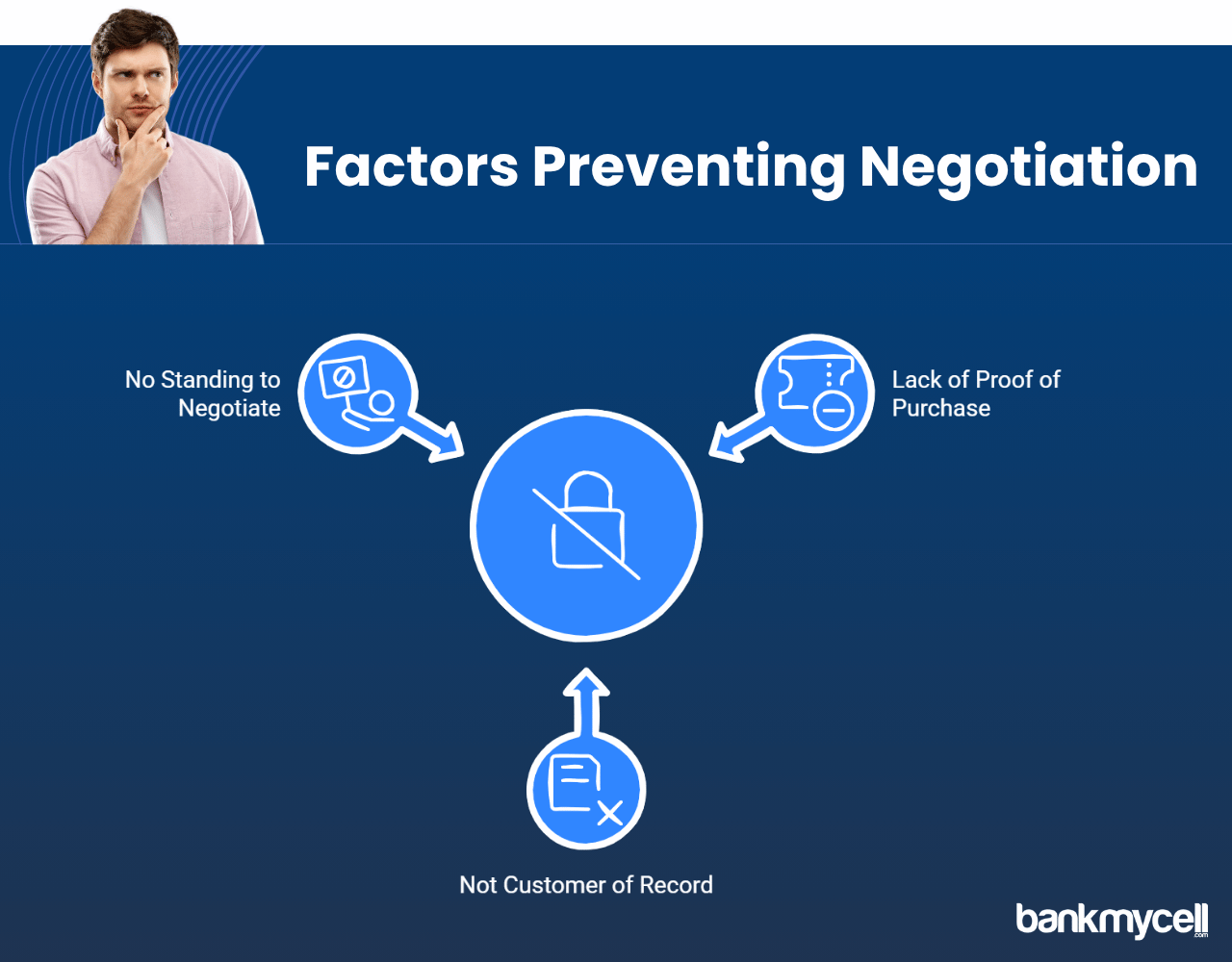

Difficulty Proving Ownership

Even if the buyer tries to resolve the situation, they face an uphill battle:

- They don’t have a valid proof of purchase from the original retailer

- They aren’t the customer of record with the carrier

- They have no standing to negotiate with the financing company

This means they’re effectively stuck with a device they can’t use as intended and can’t easily resolve the situation.

Alternatives to Selling a Financed iPhone

Given the serious consequences outlined above, what are your options if you need to get out of a phone payment but don’t want to face these issues?

Pay Off the Phone Before Selling

The cleanest option is to simply pay off the remaining balance before selling the device.

Benefits of this approach:

- You legally own the device and can sell it without consequences

- The buyer gets a clean, usable phone

- Your credit remains intact

- You avoid potential legal issues

While this requires an upfront investment, it often makes financial sense when you consider the consequences of not doing so.

Transfer the Payment Responsibility

Some carriers offer options to transfer payment responsibility to another person.

This usually requires:

The new owner to pass a credit check

Both parties to agree to the transfer

Completion of specific paperwork with the carrier

Approval from the financing company

This option is less common but worth exploring if available through your carrier.

Trade In Through Official Channels

Many carriers and manufacturers have trade-in programs that accept financed phones, applying the trade-in value toward your remaining balance.

This approach offers:

- A legitimate way to “sell” a financed phone

- Reduction of your remaining balance

- No negative consequences for either party

- Often, a path to a new device

While you might not get as much money as through a private sale, the legal protection may be worth the difference.

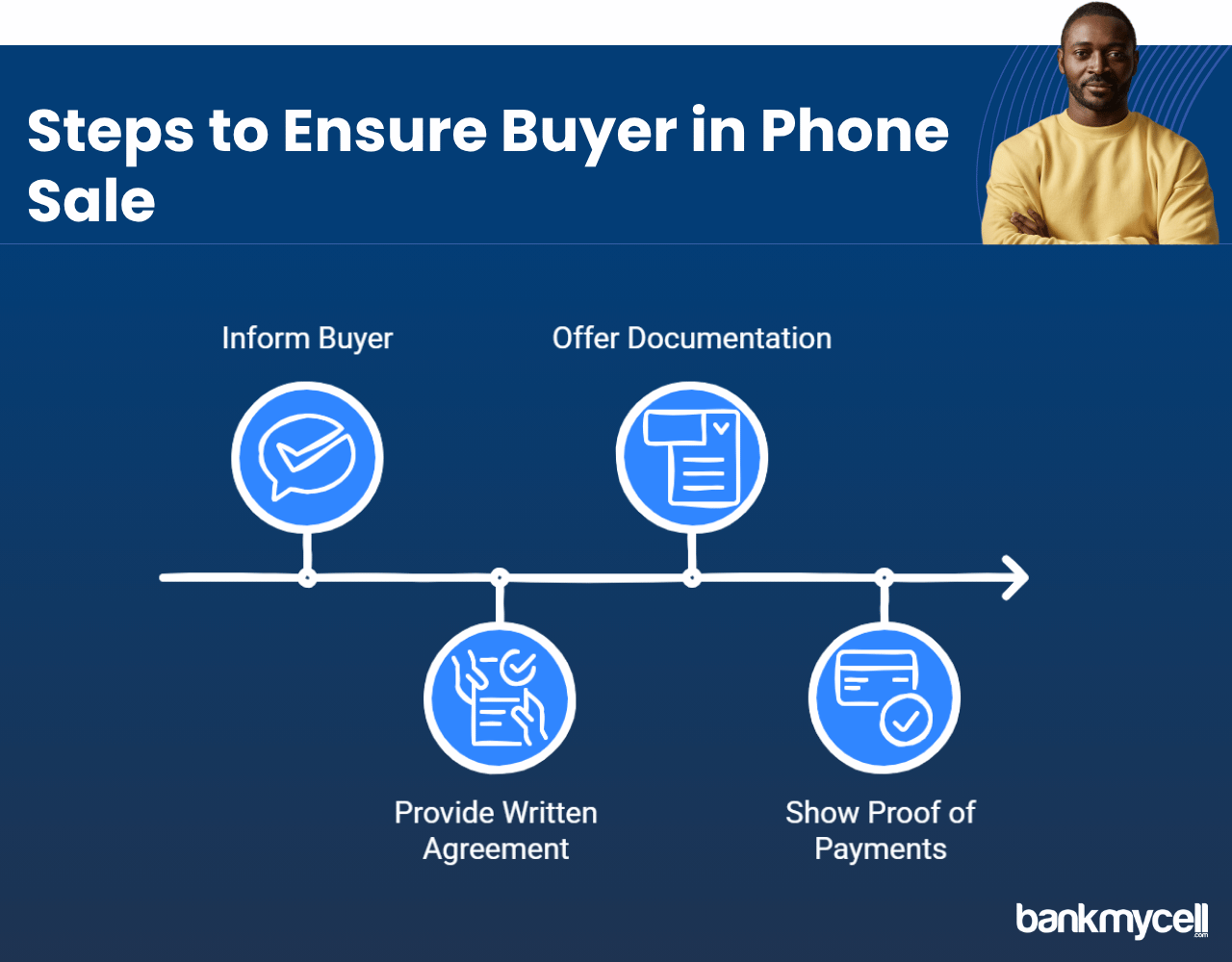

Be Transparent with Potential Buyers

If you must sell a financed phone, complete transparency is essential.

This means:

- Explicitly informing the buyer that the phone is still being paid off

- Providing a written agreement that you’ll continue payments

- Offering documentation about the payment status

- Being prepared to show proof of continued payments

This approach doesn’t eliminate all risks, but it does reduce the potential for fraud claims and gives the buyer informed consent.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

Helpful FAQ's

Can I sell a phone if I still owe money on it?

Technically, you can sell the physical device, but legally you don’t have full ownership rights to transfer until it’s paid off. Selling a financed phone typically violates your contract terms and can lead to numerous consequences for both you and the buyer.

Will my carrier know if I sell my financed phone?

Your carrier may not immediately know you’ve sold the device, but they will notice if the phone is activated on another account while still being financed under your name. Additionally, if you stop making payments, they’ll eventually blacklist the device, which affects the new owner.

How long until a phone gets blacklisted for non-payment?

The timeline varies by carrier, but typically phones are blacklisted after 30-90 days of missed payments. Some carriers may blacklist the device after just two missed payments, while others might wait until the account goes to collections.

Can a blacklisted phone be unblacklisted?

Yes, but only by the carrier that blacklisted it, and usually only after the outstanding balance is paid in full. The buyer cannot remove the blacklist status, as they have no relationship with the carrier or financing company.

What happens to my credit if I sell a financed phone and stop paying?

Your credit will be negatively impacted when you stop making payments, regardless of whether you’ve sold the phone. The missed payments, collections account, and potential legal judgments can reduce your credit score by 50-100 points or more and remain on your credit report for up to 7 years.

Wrapping It Up

Selling a phone that isn’t paid off carries significant consequences that can affect your finances, legal standing, and someone else’s property. These consequences aren’t worth the short-term gain from selling the device.

By understanding what happens when you sell a financed iPhone, you can make better decisions:

- The financial consequences can follow you for years through credit damage

- The legal risks include breach of contract and potential fraud charges

- The technical consequences can leave an innocent buyer with an unusable device

- There are legitimate alternatives that protect everyone involved

Remember, the best approach is to fulfill your financial obligations before selling. If that’s not possible, explore official trade-in options or be completely transparent with potential buyers about the phone’s status.