Can You Trade In a Phone That Isn't Paid Off? Complete Buyer's Guide

60-Second Summary

Can You Trade In An Unpaid For Phone? Yes. Although, you must pay off the balance first. Your phone is collateral against your monthly payments until the device is fully paid. Trading your device before settling your account is illegal and can get your credit score affected and your device blacklisted.

Four Safe Ways To Upgrade

1. Pay Off First ✅ Most Secure

- Call carrier to find out your exact payoff amount

- Pay off remaining balance in full

- Trade it anywhere for the full value

- Compare deals with BankMyCell comparison tool to get best payout and even cover balance remaining

2. Carrier Upgrade Programs ✅ Safe & Secure

- Verizon Unlimited Upgrade Program – upgrade with no interest and after just 50% of your balance paid

- AT&T Next Up Program – $5/month for early upgrades

- T-Mobile Jump! Upgrade Program – after just 50% of your balance is paid off

- Apple iPhone Upgrade Program – monthly payments with annual upgrades

3. Sell Then Pay Off Remaining ⚠️ Timing Sensitive

- Check your market quote with a buyback service

- Ensure that your sale price is above your remaining balance

- Pay the carrier the day of the sale

- Get free instant quotes from BankMyCell to be sure you won’t lose money first

4. Third-Party Buyback ⚠️ Risky

- Some buyback services will accept your financed device

- Be aware that you are still on the hook for your payments

- Device will be blacklisted if you miss payments

- Potential to damage credit score

Things To Avoid

Phone Blacklisting: The device will no longer work for cellular data, calls, and texts Credit Score Damage: Default information stays on your report for 7 years

Criminal Consequences: Selling your device without telling the carrier can be fraud Seller’s Responsibility: The original purchaser remains liable

Carrier Upgrade Policies

Verizon: The device will automatically unlock after 60 days but is eligible to be traded in once the balance is paid in full AT&T: The device is not unlocked until paid in full but can receive bill credit promotions T-Mobile: Device unlocking is less strict, several upgrade programs Apple: Independent upgrade program, eligible for annual upgrades

Safest Upgrade Strategies

- Complete Device Payment – the best way to cover all your bases

- Refinancing the Device – monthly payments are reduced

- Keep Your Current iPhone – keep for 5-7 years with software support

- Private Sale After Complete Payment – get top dollar return

Bottom Line: The best practice for the safest phone upgrade is to either fully pay off your device or use your carrier’s recommended early upgrade program. It also means you don’t run the risk of any legal entanglements or complications with the carrier since you paid off your device. If you sell your device to a third party before clearing your account, it is still your responsibility to cover the monthly payment. Is your phone on a monthly payment plan and you want to sell it for the maximum possible amount? BankMyCell accepts all phones that are on any kind of payment plan. Safely compare offers from verified and trusted buyback companies, with free shipping and receive the best offer so that you can put more money towards your next iPhone.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

| TODAY'S BEST iPHONE BUYBACK OFFERS | |||

|---|---|---|---|

| Device | Financed | ||

| iPhone 17 Pro Max | $1460.00 | Compare | |

| iPhone 17 Pro | $1070.00 | Compare | |

| iPhone 17 | $680.00 | Compare | |

| iPhone Air | $640.00 | Compare | |

| iPhone 16e | $410.00 | Compare | |

| iPhone 16 Pro Max | $1095.00 | Compare | |

| iPhone 16 Pro | $920.00 | Compare | |

| iPhone 14 Pro Max | $620.00 | Compare | |

| iPhone 14 Pro | $450.00 | Compare | |

| iPhone 14 Plus | $315.00 | Compare | |

| iPhone 14 | $285.00 | Compare | |

| iPhone 13 Pro Max | $330.00 | Compare | |

| iPhone 13 Pro | $270.00 | Compare | |

| iPhone 13 Mini | $155.00 | Compare | |

| iPhone 13 | $165.00 | Compare | |

| iPhone 12 Pro Max | $220.00 | Compare | |

| iPhone 12 Pro | $160.00 | Compare | |

| iPhone 12 Mini | $135.00 | Compare | |

| iPhone 12 | $135.00 | Compare | |

| iPhone 11 Pro Max | $175.00 | Compare | |

| iPhone 11 Pro | $195.00 | Compare | |

| iPhone 11 | $130.00 | Compare | |

| * Best market prices updated February 19th 2026 | |||

Data Source: BankMyCell compares over 100,000+ quotes and customer reviews from 20+ trusted buyback stores every 15 minutes via our data feeds, making us America’s #1 time-saving trade-in supermarket.

Trading in a phone you haven’t finished paying off depends on your carrier and your personal situation but usually requires paying off your remaining balance first. The Answer

The short answer is: The ability to trade in your device depends on your specific situation and carrier but generally requires paying off any outstanding balance first.

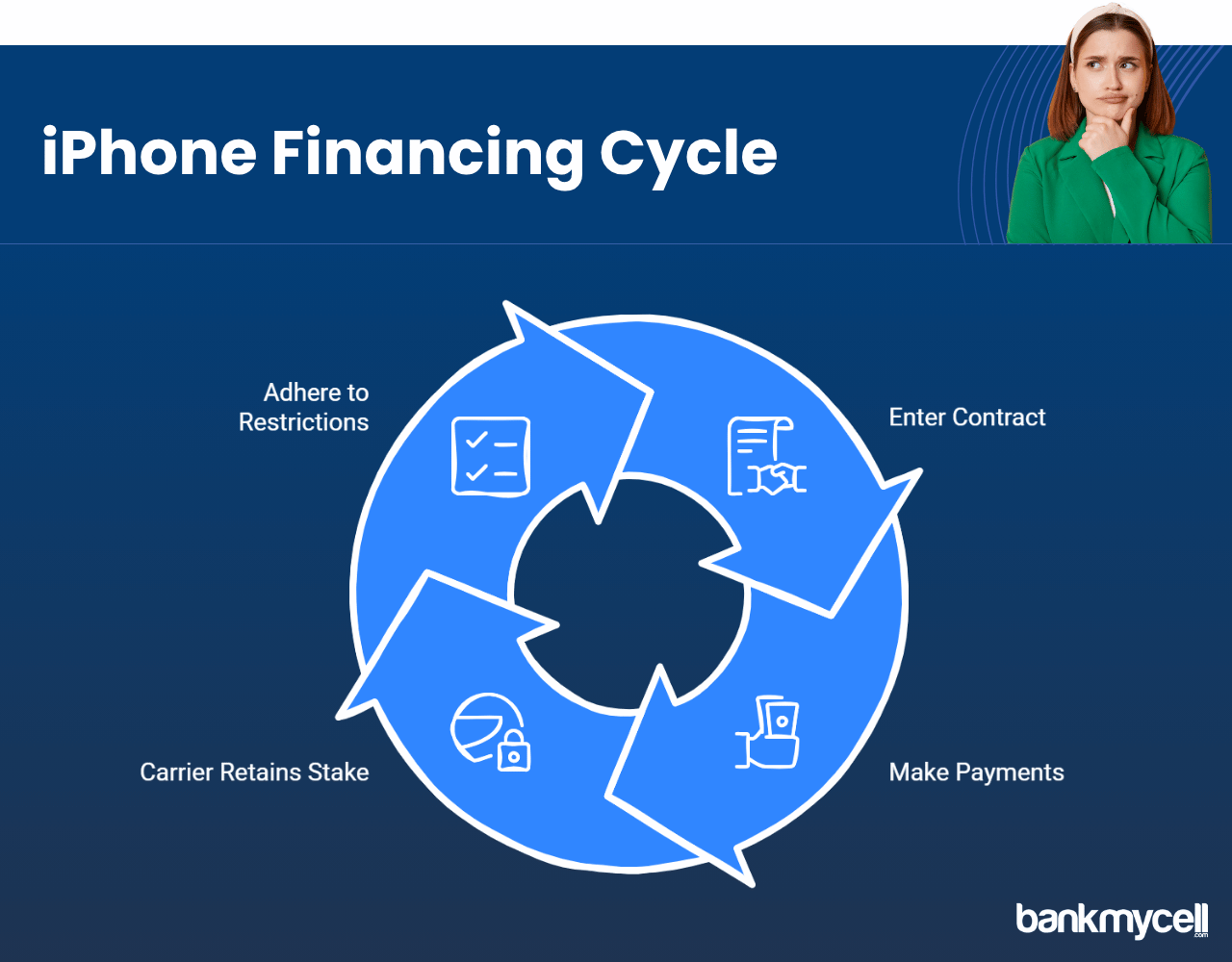

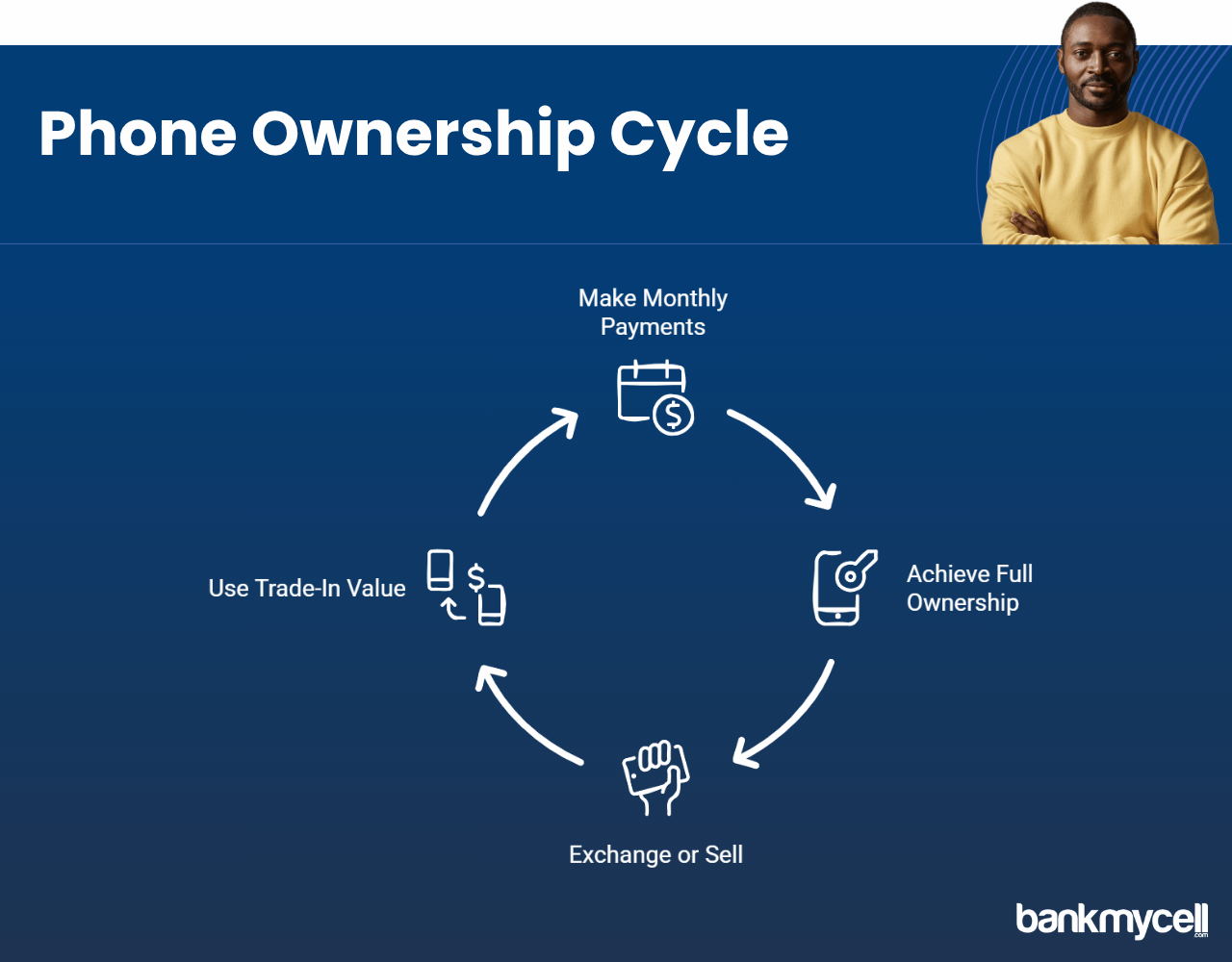

Buying an iPhone through a carrier financing plan or installment agreement means you’re obtaining a loan for the device. You have a payment plan through the carrier to pay the phone off over 24-36 months but must complete all payments before you gain full ownership of the device.

This means:

- Your iPhone remains “under contract” until you complete all payments.

- The carrier retains financial stakes in your device until you complete all payments.

- The payment plan contract details permissible activities and restrictions for the device during its financing period.

Can you sell your car through a bank when you haven’t completed your payments? Your financed phone operates under similar rules when determining its trade-in value.

You can upgrade or trade your device before full payment through legitimate methods, which this guide will discuss.

You want to upgrade your iPhone but are still paying off your current device.

BankMyCell enables users to compare buyback values from reputable stores to maximize their return and possibly settle their remaining balance.

Four trade-in options exist when you want to exchange a phone that you haven’t finished paying off.

If you want to trade in a phone with an outstanding balance you typically have four possible options available to you.

1. Pay Off the Balance First

Clearing the remaining balance on your iPhone before selling it represents the most direct and secure option.

Here’s how to do it:

- Reach out to your carrier to determine how much you need to pay off your balance.

- Pay the remaining balance in full

- After your device reaches payoff status you can trade it in at any location to receive its full trade-in value

- Apply the trade-in credit to the purchase of your next device.

Following this method lets you prevent any contract breaches and credit problems. You must have enough available funds to settle your remaining balance.

2. Take advantage of your carrier's Trade-In Program to upgrade your device before fully paying it off.

Major carriers design trade-in programs to benefit customers who wish to upgrade to new devices before their existing ones are fully paid off.

There are generally two methods of operation for these trade-in programs.

- Through this trade-in option, you can exchange your old device for a new phone while having the outstanding balance either eliminated or transferred to your new payment plan.

- Make a partial payment of your remaining balance, typically 50%, to qualify for a device upgrade.

The main carrier trade-in programs include:

- Verizon’s Annual Upgrade Program

- AT&T’s Next Up

- T-Mobile’s Jump! and Jump! On Demand

- Apple’s iPhone Upgrade Program

These programs provide the safest method to upgrade your device before finishing your payment plan because they are tailored to this function without breaching your contract terms. The amount of trade-in credit that each promotion offers varies based on the specific model of your device.

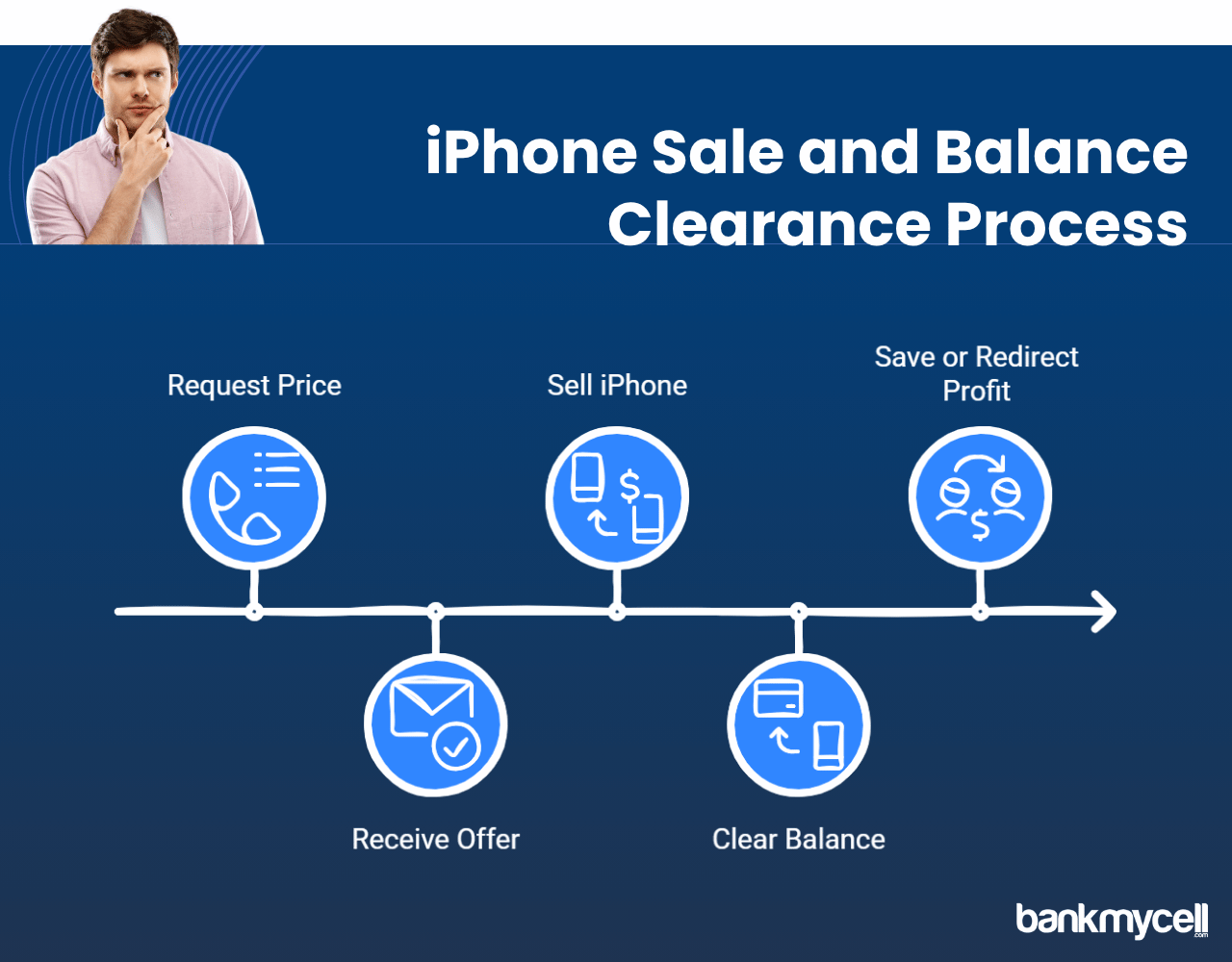

3. Use the money from selling your iPhone to settle your outstanding balance with the service provider.

You can sell your iPhone to someone else and then apply the money received to settle your carrier balance.

Here’s how this process works:

- Request a price for your iPhone through a buyback service or market platform to establish its current market value

- Once you receive an offer that is higher than your remaining balance you should move forward with the sale.

- The funds you receive from selling your device should be used to clear your balance with the carrier.

- Either save any remaining profit or redirect it towards purchasing your subsequent phone.

This strategy tends to succeed when your iPhone’s market price is higher than your remaining carrier balance which frequently happens with newer phones that are well-maintained or devices with minor screen damage.

But here’s the truth:

This option requires careful timing and coordination. Before transferring ownership of the device to the buyer you must ensure that the sale proceeds are available to pay off the carrier balance.

4. Trade In to a Third-Party Buyback Service

Certain buyback services and retailers including Best Buy allow financed phones as trade-ins but important exceptions apply.

- The responsibility for any outstanding payments on your carrier account stays with you.

- Failing to continue your payments could lead to the device being blacklisted by your carrier.

- Once the new owner inserts a SIM card into the device and it becomes blacklisted they will not be able to activate it.

- Your credit score could be negatively affected

The advantage of this method:

- This method lets you receive instant worth from your device.

- There are specific buyback services which focus on phones that are still under financing agreements.

The disadvantage:

- The method exposes users to major financial liabilities and credit score complications.

- Engaging in this practice could breach the agreement terms you have with your telecommunications service provider.

Find out what your iPhone is worth for trade-in today.

BankMyCell enables users to assess offers from reliable buyback vendors for their financed devices.

Selling or trading your financed phone before fully paying it off brings significant risks and consequences for both you and the new owner.

When you trade in or sell your financed phone without paying the remaining balance, you face serious ownership transfer consequences.

Risks and Consequences

Device Blacklisting

Non-payment of your financed iPhone after trading it in will result in your carrier blacklisting the device’s IMEI number.

- Your service provider may place your IMEI number on the blacklist.

- The device will lose access to cellular networks across all major service providers.

- The new owner will operate the device using only WiFi connectivity.

- The device’s blacklisting status remains permanent until the outstanding balance is fully paid.

Credit Score Impact

Defaulting on your carrier payment agreement has the potential to harm your credit score.

- Credit bureaus may receive information about any outstanding balance.

- Your credit score could drop significantly

- A negative credit report mark will stay visible for seven years.

- Your ability to secure financing for future devices will probably face restrictions or higher costs.

Legal Implications

Certain situations may result in legal repercussions.

- If you sell a device that is still under financing without informing the buyer about its current status you could be committing fraud.

- The company providing your service may initiate collection activities or take legal measures to recover the outstanding debt.

- You could face civil liability if the buyer files a lawsuit against you for selling them a blacklisted device.

Ethical Considerations

The sale of a financed phone brings up ethical issues in addition to legal and financial risks.

- It’s unfair and lacks transparency for buyers when sellers fail to reveal that a device is still under financing.

- The buyer receives a device that they cannot use because it has been blacklisted.

- Other people could lose access to a device they purchased because of your actions

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

How Carriers Handle Financed Phone Trade-Ins

The trade-in policies for financed devices vary between each major carrier.

Verizon Trade-in Policies

Verizon provides multiple solutions for customers who have devices under financing arrangements.

- Eligible customers can access upgrades once they have paid half of their device’s cost through the annual upgrade program.

- Verizon accepts devices for trade-in but requires you to settle any outstanding balance.

- Verizon sometimes offers special trade-in deals which enable customers to upgrade devices earlier than usual according to set terms and promotional values.

Key consideration: The value of Verizon devices increases on the secondary market after they automatically become unlocked 60 days following purchase although they may be financed.

AT&T Trade-in Policies

AT&T’s approach to financed device trade-ins includes:

- The Next Up program offers customers the opportunity to upgrade their devices after paying off 50% of the total cost by paying $5 more per month.

- Standard installment plans mandate full repayment of the device before you can upgrade.

- AT&T regularly provides trade-in offers to reduce your remaining device balance using bill credits.

Key consideration: AT&T usually demands full payment on devices before unlocking them which affects the devices’ resale value.

T-Mobile Trade-in Policies

Customers enjoy great flexibility when upgrading their devices through T-Mobile’s options.

- Jump! : Users can upgrade devices once they have paid off half of their balance but must pay an additional fee each month.

- Jump! On Demand: The lease-based Jump! On Demand program allows customers to upgrade their devices three times annually.

- Customers can use their trade-in value to pay down their remaining balance or apply it toward their bill credits.

Key consideration: Some cases show that T-Mobile displays more flexibility in unlocking devices which impacts their trade-in options.

Apple's iPhone Upgrade Program

The iPhone Upgrade Program from Apple deserves recognition as an alternative to carrier options.

Best Practices and Alternatives

Complete Your Payment Plan

When managing financial obligations the best choice typically involves:

Pay for your device in full through continued monthly payments

Exchange or market your device after acquiring complete ownership

Allocate your entire trade-in value to purchase your next device.

Refinance Your Device

Some services allow you to:

- Refinance your remaining phone balance

- Potentially secure a lower monthly payment

- Gain more flexibility with the device

Keep Your Current iPhone Longer

Consider that:

The iPhone receives software support for between five to seven years.

Purchasing a battery replacement between $69 to $99 will greatly prolong the device’s functional time span.

You’ll experience more significant technological improvements if you skip a generation before upgrading your device.

Sell Privately After Payoff

You may get more value by:

- Completing your payment plan

- Unlocking your device through your carrier

- You could receive better market value by selling your phone privately rather than trading it in.

Helpful FAQ's

Can I sell/buy back a phone that is not paid off?

Technically yes, but it is not recommended. The safest routes are either using your carrier’s official trade in program or simply paying off your phone first. There are buyback companies out there that will buy a phone even if it is financed, but be aware that you are still responsible for continuing to make payments to your carrier.

Will my carrier unlock my iPhone if it is not paid off?

Carriers will typically only unlock a device once it’s fully paid off. Verizon is the main exception since devices will automatically be unlocked after 60 days regardless of payment status.

What happens if I sell/buy back a financed phone and stop payments?

If you stop paying, your carrier will most likely blacklist the device (making it unusable on any cellular network), ding your credit (making your credit score go down), and take collections actions against you.

Do buyback companies check if an iPhone is paid off?

Buyback companies should check the device’s IMEI to make sure it is not reported lost or stolen, but they may not be able to see if it’s still being financed. However, if someone sells a phone that is currently being financed and it gets blacklisted later, the device could get blacklisted from being used on any cellular network which can cause both buyer and seller issues.

Can I apply trade in value to my remaining balance?

Yes and this is typically a great way to go. If the trade-in value is more than your remaining balance, you can use the cash to pay off your device and pocket the difference. You can also use trade-in promotions some carriers offer which might help to pay down your remaining balance on a new device purchase.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

Wrapping It Up

You can trade in an unpaid phone yet must thoroughly evaluate your choices while recognizing possible repercussions.

The instructions in this guide will help you:

- Assess all relevant factors before deciding to trade in your phone which is still under financing.

- Learn about the approved methods for early upgrade to a new device

- Protect your financial reputation by steering clear of activities that could harm your credit standing.

- Attain the highest possible trade-in value when exchanging your device.

The safest methods to upgrade your device are through full repayment of your financed device or by participating in your carrier’s early upgrade program. Different methods to trade or upgrade financed devices exist but they present various risks requiring careful assessment of potential benefits.

What knowledge do you have regarding upgrading or trading devices that are still under finance agreements? Which strategies have proven to be more effective in your experience?