Sprint-Specific Guide to Selling Financed iPhones and Devices With Remaining Balance

60-Second Summary

Sell a Financed Sprint iPhone

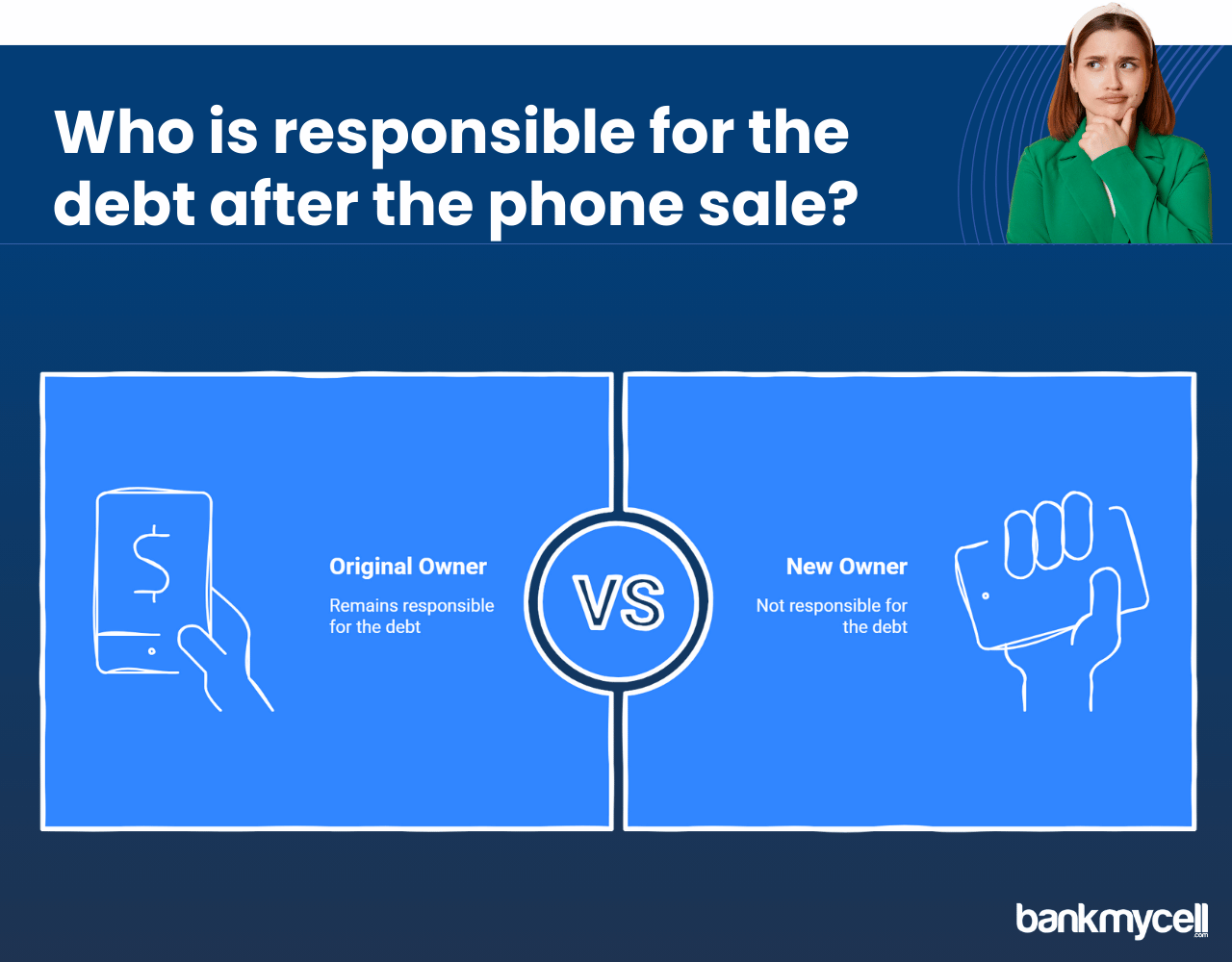

It is legal to sell a financed Sprint iPhone. You are still responsible for any remaining payments on the device even after selling it.

Essential Considerations Before Selling

- Verify your payment status – Check the remaining balance and expected payoff period

- Carrier restrictions – Sprint devices remain network-locked until fully paid

- Legal responsibilities – Financing agreement remains your responsibility

Three Options for Selling

1. Pay Off Balance First (Recommended)

Pay off the financing early before selling for best resale value and no complications. Compare payout prices using BankMyCell to see if this is financially viable based on current trade-in values .

2. Sell While Making Payments

Continue making monthly payments after selling and disclose to the new owner. Buyer must trust and sign written agreement.

3. Trade-In Programs

Trade-in to a carrier if you are eligible for balance to be waived when upgrading to a new phone.

Risks Associated

- Payment delinquency – Blacklist risk if you stop payments

- Buyer complications – Network issues for new owner

- Credit score damage – Unpaid balances sent to collections and hurt credit score

Mandatory Buyer Disclosure

Selling Sprint iPhones requires you to inform the buyer of:

- Remaining balance and expected payments

- Network locked status until paid

- Your future payment liability

Bottom Line: Pay off your financed Sprint iPhone balance before selling if possible. If unable to pay off, only sell with full buyer disclosure and in trusted channels with written payment responsibility agreements.

Don’t have the funds to pay off your balance or have a broken device you need to sell? BankMyCell accepts financed Sprint iPhones for sale in all conditions with guaranteed data wiping for security. Receive competitive buyback offers from trusted shops for your broken iPhone and ship for free, allowing you to recover some of its value toward a new device instead of taking on new payment responsibilities.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

| TODAY'S BEST iPHONE BUYBACK OFFERS | |||

|---|---|---|---|

| Device | Financed | ||

| iPhone 17 Pro Max | $1460.00 | Compare | |

| iPhone 17 Pro | $1070.00 | Compare | |

| iPhone 17 | $680.00 | Compare | |

| iPhone Air | $640.00 | Compare | |

| iPhone 16e | $410.00 | Compare | |

| iPhone 16 Pro Max | $1095.00 | Compare | |

| iPhone 16 Pro | $920.00 | Compare | |

| iPhone 16 Plus | $610.00 | Compare | |

| iPhone 16 | $475.00 | Compare | |

| iPhone 15 Pro Max | $780.00 | Compare | |

| iPhone 15 Pro | $700.00 | Compare | |

| iPhone 15 Plus | $385.00 | Compare | |

| iPhone 15 | $395.00 | Compare | |

| iPhone 14 Pro Max | $620.00 | Compare | |

| iPhone 14 Pro | $450.00 | Compare | |

| iPhone 14 Plus | $315.00 | Compare | |

| iPhone 14 | $285.00 | Compare | |

| iPhone 13 Pro Max | $330.00 | Compare | |

| iPhone 13 Pro | $270.00 | Compare | |

| iPhone 13 Mini | $155.00 | Compare | |

| iPhone 13 | $165.00 | Compare | |

| iPhone 12 Pro Max | $220.00 | Compare | |

| iPhone 12 Pro | $160.00 | Compare | |

| iPhone 12 Mini | $135.00 | Compare | |

| iPhone 12 | $135.00 | Compare | |

| iPhone 11 Pro Max | $175.00 | Compare | |

| iPhone 11 Pro | $195.00 | Compare | |

| iPhone 11 | $130.00 | Compare | |

| * Best market prices updated February 19th 2026 | |||

Data Source: BankMyCell compares over 100,000+ quotes and customer reviews from 20+ trusted buyback stores every 15 minutes via our data feeds, making us America’s #1 time-saving trade-in supermarket.

You want to sell your AT&T iPhone, which still has payments left on its installment plan?

People commonly face situations where they owe monthly payments for their AT&T financed iPhone yet need to upgrade or obtain immediate funds through selling their phone. You need to understand important aspects of your phone contract and outstanding balance before selling a phone that remains under contract.

Here’s the problem:

Most sellers find out too late that selling an AT&T financed iPhone with an outstanding balance involves serious restrictions and potential consequences regarding monthly payments.

And that’s not all…

Your monthly payments to AT&T service provider continue regardless of selling the phone. Monthly payments to your service provider continue even after you sell the financed phone while still owing money on it.

Understanding AT&T's Monthly Installment Plan for Devices

AT&T’s installment plan which used to be called AT&T Next enables customers to buy cell phones by making monthly payments over a span of 30-36 months to avoid the full upfront cost of an unlocked phone.

This is what takes place when you buy an iPhone through AT&T’s financing program:

- The agreement requires you to pay the entire device cost.

- This payment is structured into uniform monthly installments that usually last between 30 and 36 months.

- Your monthly AT&T bill with your service provider includes these installments.

- The phone stays with AT&T until you have completed all payments

- While you technically own the device, your ownership is limited due to financial responsibilities connected to your mobile phone.

Think about it:

Financing a phone through AT&T requires you to pay its full price, whether you keep it or not.

AT&T’s financing model requires customers to pay both for their mobile device and their service plan commitments. Selling a device that has outstanding payments presents a distinct scenario.

Compare different buyback offers for your AT&T iPhone. BankMyCell enables you to secure optimal pricing by comparing multiple reputable buyback stores for phones that still have outstanding balances.

Yes, it is legal to sell an AT&T phone with remaining payments, though you must manage the outstanding balance responsibly.

It is possible to sell an AT&T phone that isn’t fully paid off but you need to understand the important conditions concerning the remaining balance.

Your Financial Obligations and Monthly Payments Remain

Selling an AT&T iPhone that remains under contract without full payment completion leaves you accountable for the remaining balance.

- The legal responsibility for the remaining balance of the payment plan stays with you.

- You will keep receiving monthly charges on your AT&T bill.

- Your credit score faces negative effects when payments on the financed device go unpaid

- Your phone will be put on a blacklist if you fail to pay your service provider

Here’s the legal reality:

Your financing agreement with AT&T establishes a contractual relationship between you and AT&T instead of between AT&T and the phone’s new owner. The sale of the device does not transfer the debt responsibility nor does it allow the contract to be transferred to the new owner.

AT&T's Specific Carrier Policies

The financing policies AT&T implements for phones stand apart from those established by T-Mobile and Verizon for similar phone plans.

- AT&T phones maintain network restrictions to AT&T until full payment completion

- A phone from AT&T stays locked until full payment completion before it becomes eligible for unlocking.

- AT&T uses IMEI numbers to monitor cell phones and places blacklisted restrictions on devices with unpaid bills.

- Financial responsibility remains with the seller during sale transactions because responsibility transfer does not occur automatically.

Understanding network provider restrictions is essential before attempting to sell your device.

When selling an AT&T financed iPhone you have multiple options to choose from that impact your monthly payments differently.

You can choose from multiple methods for selling an AT&T iPhone with remaining payments since each option presents unique implications for your payment schedule.

Your Selling Options

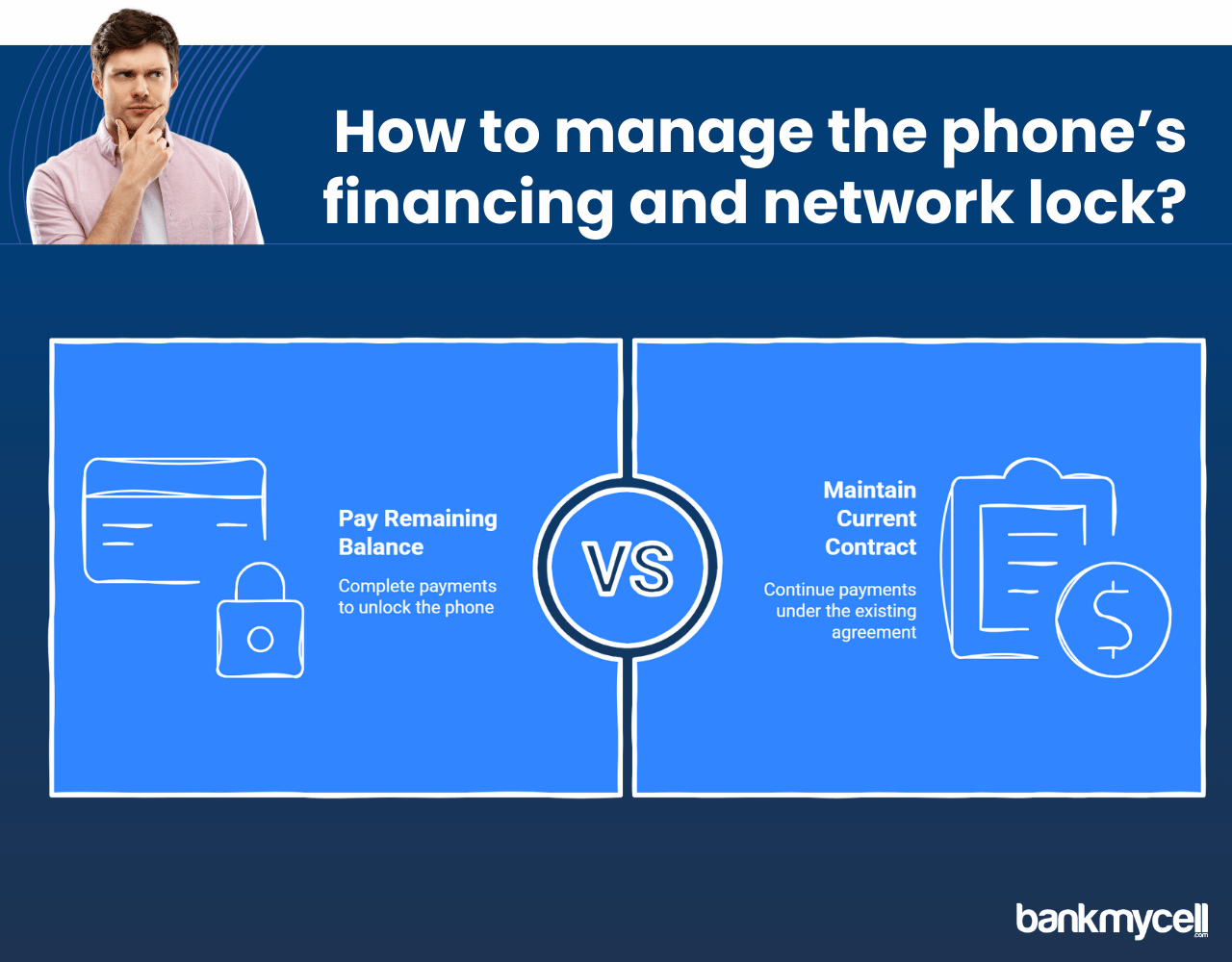

Option 1: Pay Off the Balance First (Recommended)

Selling a phone through this method guarantees both ethical integrity and cleanliness.

- Access your myAT&T account or reach out to customer service for further assistance.

- Contact AT&T customer service or check your myAT&T account to find out how much you need to pay to settle your device financing.

- Settle the outstanding balance completely before your contract reaches its end date.

- After your device has been fully paid off ask AT&T to unlock it.

- Sell your unlocked phone, which you have fully paid for, to the next buyer.

The advantage of this method:

- Potential buyers will probably pay more for a phone that doesn’t have carrier restrictions.

- Neither you nor the buyer faces any complications through the payment plan process.

- Complete elimination of future payment responsibilities and monthly charges

- No risk to your unsecured credit score

- The phone becomes compatible with multiple carriers after it has been unlocked

Option 2: Sell While Continuing to Make Payments

People who need to sell their phone without the ability to pay off the balance upfront should consider alternative selling methods.

Determine your outstanding balance by multiplying the remaining payments by the monthly payment amount specified in the contract.

Make all payments until you pay off your device in full

Make sure buyers understand that the phone’s financing continues during the sale.

The AT&T network will continue to exclusively lock the phone to its services.

Provide a written agreement regarding payment responsibilities

But here’s the truth:

The buyer-seller relationship must be built on strong trust for this option because you will continue to handle payments even after you’ve stopped using the phone.

Option 3: Use AT&T's Next Up Program (If Eligible)

Your phone contract included AT&T’s Next Up program which required an extra $5/month fee:

- After paying 50% of its cost you may trade in your current device.

- Users can exchange their old device for a new device or a new phone.

- The old phone’s remaining balance will be cleared straight away.

- AT&T requires that all trade-ins occur directly through their system without using external buyback services.

The limitation:

Technically, you aren’t selling your phone, but this method lets you get rid of your payment requirements when upgrading without facing early termination fees.

Ready to sell your AT&T iPhone? BankMyCell connects buyers and stores which accept all iPhone conditions including devices with active financing balances.

Selling a financed AT&T iPhone includes possible risks such as remaining payment obligations and other penalties.

When you plan to sell your AT&T iPhone on finance, you must consider the risks associated with an incomplete payment balance.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

Risks and Considerations

Risk 1: Payment Default Consequences if You Stop Paying

The phone becomes unusable on most US carriers when payments for a device with an invalid IMEI stop.

- AT&T could blacklist the phone’s electronic serial number

- Most US carriers will not accept the phone due to its bad IMEI status.

- Your credit score without security backing stands to take heavy damage.

- AT&T has the right to forward your unpaid account to collections which could bring about legal actions against you.

- The contract terms will subject you to extra charges and penalties.

Risk 2: Buyer Complications with a Leased Phone

The phone’s condition may present problems for the purchaser.

- The buyer encounters problems either when trying to unlock the phone or after changing their service provider.

- Restrictions to the AT&T network only

- Potential sudden blacklisting if you stop paying

- Software updates and warranty service become problematic after performing a factory reset.

- Financed phones experience reduced resale value because they remain locked to their original carrier.

Risk 3: AT&T Early Termination Possibilities on Payment Plan

In some cases with financed phones:

AT&T’s contract terms permit them to require customers to pay off their remaining balance without delay.

They can trigger immediate balance payment if similar device transfers happen without authorization

The outstanding balance may become payable at once when an applicable ETF is applied.

The contract terms permit this outcome but it remains an uncommon event.

Communicating with Buyers

Potential buyers must be fully informed about your AT&T iPhone’s financial status when selling it because you still make payments on the phone.

You must ethically inform prospective buyers when selling your AT&T iPhone that you are still making payments on it.

Required Disclosures to Potential Buyers:

- The iPhone remains under financing through AT&T and has unpaid balances still due.

- Provide both the remaining balance amount and the total number of payments left under the contract.

- The AT&T network lock on the phone will persist until you complete all payments.

Best Places to Sell Your Sprint iPhone When Switching Carriers

Depending on your device’s payment status and your personal priorities when switching carriers, here are the best options for selling your Sprint iPhone:

For Fully Paid Sprint iPhones When Getting a New Phone

If you’ve paid off your device completely and want a new device:

1.Private Sale (eBay, Facebook Marketplace, Craigslist)

- Highest potential return when you compare prices

- Control over pricing and terms

- Must handle shipping/meeting and payment processing

2. Buyback Services (BankMyCell, Gazelle, ecoATM)

- Convenient and quick process for selling cell phones

- Guaranteed payment

- Typically lower returns than private sales but you can compare prices

3. Trade-In Programs (T-Mobile, Apple, Best Buy

- Extremely convenient if purchasing a new device or new phone

- Instant credit toward new purchases on your first bill

- Usually lower value than other options but might avoid applicable ETF

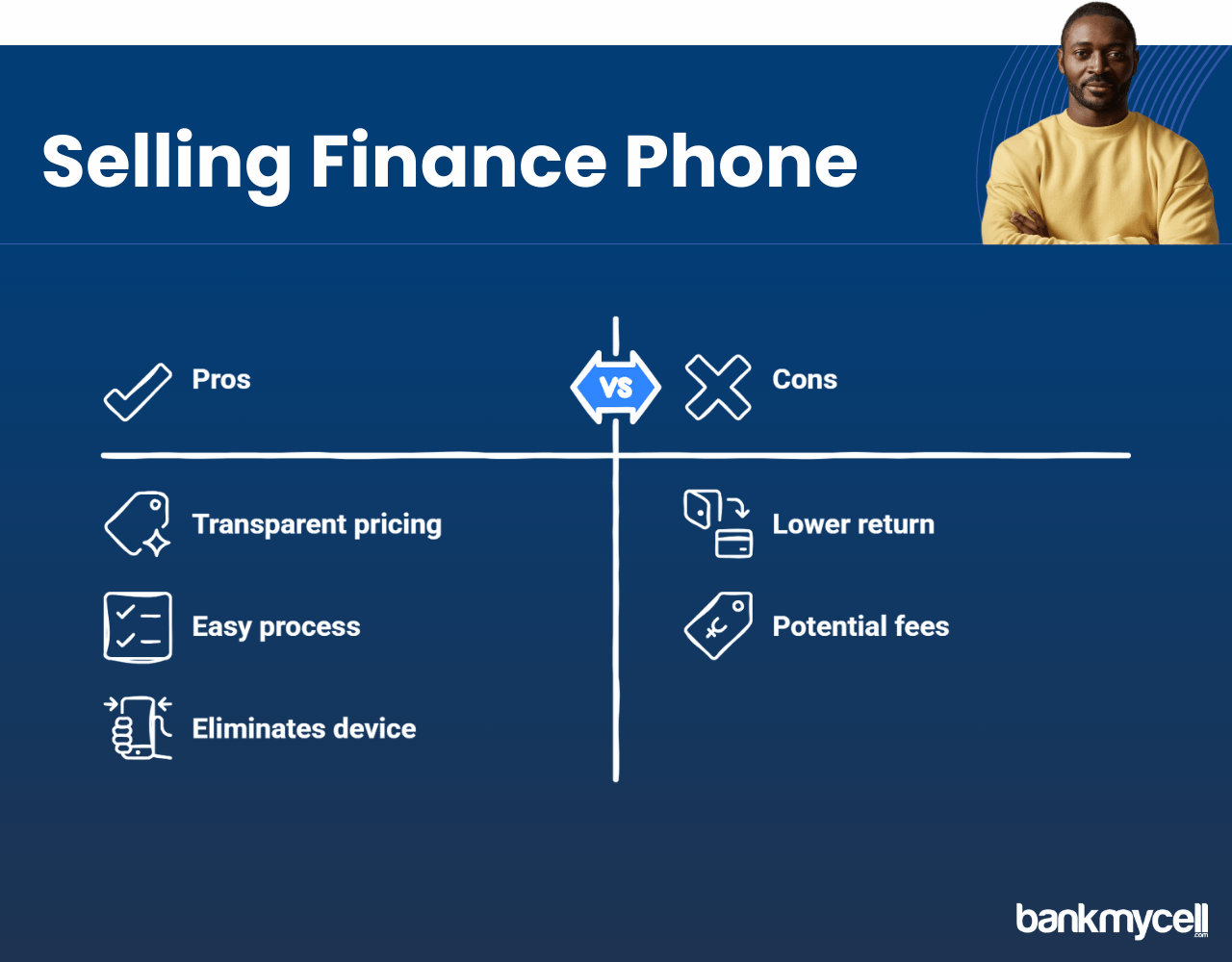

For Fully Paid Sprint iPhones When Getting a New Phone

If your device still has an outstanding balance on the device payment plan:

1.Specialized Buyback Services for Financed Phones

- Some buyback companies accept financed phones with transparent pricing

- Easy process with clear expectations for selling your financed phone

- Lower return but eliminates the device from your possession

2. Private Sale with Disclosure When You Owe Money

- Requires complete honesty about the device’s status and remaining balance

- Need formal agreement about continued making payments

- Higher risk for both parties but possible when buying financed devices

3. T-Mobile Trade-In Program

- May allow trade-in toward a new device while transferring the balance

- Keeps everything within the same carrier ecosystem

- Limited flexibility but potentially lower risk when you owe money

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

Helpful FAQ's

Can I sell my Sprint iPhone if I still owe money on it?

Yes, you can sell a Sprint iPhone that’s not paid off, but you remain legally responsible for the remaining payments. Your best options are to either pay off the balance, sell with full disclosure to the buyer, or use a specialized buyback service that accepts financed phones.

Will T-Mobile unlock my Sprint iPhone if I still owe money on the device payment plan?

No, T-Mobile (which now owns Sprint) generally requires devices to be fully paid off before they’ll provide an unlock code, unlike some Verizon policies. Unlocked phones typically have higher resale values and work on more networks when switching carriers.

What happens if I sell my financed Sprint iPhone and stop making payments?

If you stop making payments, T-Mobile will likely blacklist the device (giving it a bad ESN preventing it from working on any carrier network), send the balance to collections, and this may negatively impact your credit score. In most cases, this causes problems for both you and the buyer.

How can I check how much I still owe on my Sprint iPhone payment plan?

Log into your T-Mobile account (where Sprint accounts have been migrated), navigate to the device payment section, and you’ll see the remaining balance. Alternatively, you can call T-Mobile customer service at 1-800-937-8997 to check your remaining monthly payments.

Does the T-Mobile merger affect my ability to sell my Sprint iPhone with a device payment plan?

Yes, the merger has changed some policies. All Sprint accounts are now managed under T-Mobile, which affects payment processing, customer service, and device unlock policies for customers. However, your original contract terms generally remain valid even after the merger when selling your financed phone.

Wrapping It Up

Selling a Sprint iPhone that’s still being financed requires careful consideration of your options and the potential consequences. With the T-Mobile merger affecting many Sprint policies, it’s more important than ever to understand where you stand before proceeding with a sale of your financed phone.

By following the guidance in this article, you can:

- Determine your device’s exact payment and lock status with the payment plan

- Choose the right selling option based on your financial situation and remaining balance

- Avoid potential legal and credit issues with your service provider

- Maximize the value you receive for your device when you compare prices

Remember, while selling a financed phone is possible, the most straightforward path is to pay off the balance first. If that’s not an option, make sure you choose a reputable buyback service that clearly explains how they handle financed phones with monthly payments.