Can You Trade In A Phone That Isn't Paid Off AT&T? Complete Policy Guide

60-Second Summary

AT&T Trade-In FAQ

- You can trade in an AT&T phone that you haven’t paid off, but you still owe them the balance, unless you have AT&T Next Up.

- AT&T’s early upgrade program (Next Up) costs $5 per month, and you can upgrade once you’ve paid 50% of the device price after 12 months – check requirements.

- If you don’t have Next Up, your trade-in options are limited and may cost you hundreds of dollars extra. See your alternatives.

Your Three Options

1. AT&T Next Up – how it works

- You have to pay $5/month as an add-on

- When you have paid 50%, you will be eligible for an upgrade.

- The remaining balance on the phone is forgiven.

- Your phone has to be in good working condition.

2. AT&T Regular Trade-In – cost breakdown

- Pay off the phone first, OR

- Trade in and still owe the original phone balance

- Run two payment plans at the same time

- Less trade-in value than BankMyCell’s vetted buyback partners

3. Third-Party Solutions – options comparison

- Buyback stores provide higher cash values

- Private sales maximize profits

- BankMyCell connects you to trusted stores that accept financed phones

- You have to be current with AT&T to avoid blacklisting

Financial Risks

- Example: $500 phone balance + $300 AT&T credit = $200 out-of-pocket

- Hidden costs: Extra fees for early upgrade, activation, condition loss – full list.

- Credit to bill, not lump sum. Bill credits are applied over 24-36 months instead of getting AT&T cash today.

Bottom Line: If you are looking to upgrade your phone early, AT&T Next Up is your only option with AT&T, and there is an extra $5 monthly cost to activate that program. If you do a regular AT&T trade-in, you end up owing more than what your phone is worth, and you get no cash in hand. AT&T won’t tell you, but your best bet is to compare their trade-in offer with BankMyCell’s buyback partners and then make a choice – the difference in cash may be hundreds of dollars.

Looking for a higher value trade-in than what AT&T is offering? BankMyCell compares offers from trusted buyback stores that will accept your financed AT&T device with you continuing to make payments. Get competitive offers for free shipping cash instead of credits towards your bill that you don’t get for years – usually hundreds of dollars more than the carrier trade-in values.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

| TODAY'S BEST iPHONE BUYBACK OFFERS | |||

|---|---|---|---|

| Device | Financed | ||

| iPhone 17 Pro Max | $1460.00 | Compare | |

| iPhone 17 Pro | $1070.00 | Compare | |

| iPhone 17 | $680.00 | Compare | |

| iPhone Air | $640.00 | Compare | |

| iPhone 16e | $410.00 | Compare | |

| iPhone 16 Pro Max | $1095.00 | Compare | |

| iPhone 16 Pro | $920.00 | Compare | |

| iPhone 14 Pro Max | $620.00 | Compare | |

| iPhone 14 Pro | $450.00 | Compare | |

| iPhone 14 Plus | $315.00 | Compare | |

| iPhone 14 | $285.00 | Compare | |

| iPhone 13 Pro Max | $330.00 | Compare | |

| iPhone 13 Pro | $270.00 | Compare | |

| iPhone 13 Mini | $155.00 | Compare | |

| iPhone 13 | $165.00 | Compare | |

| iPhone 12 Pro Max | $220.00 | Compare | |

| iPhone 12 Pro | $160.00 | Compare | |

| iPhone 12 Mini | $135.00 | Compare | |

| iPhone 12 | $135.00 | Compare | |

| iPhone 11 Pro Max | $175.00 | Compare | |

| iPhone 11 Pro | $195.00 | Compare | |

| iPhone 11 | $130.00 | Compare | |

| * Best market prices updated February 19th 2026 | |||

Data Source: BankMyCell compares over 100,000+ quotes and customer reviews from 20+ trusted buyback stores every 15 minutes via our data feeds, making us America’s #1 time-saving trade-in supermarket.

Ever wondered if it’s possible to trade in a phone that isn’t paid off AT&T? Want to understand AT&T’s specific trade-in policies regarding financed devices before you estimate trade-in value?

You’re in the right place.

Trading in a device you still owe money on can seem like an easy decision when you get a new iPhone model in your hands. However, if your AT&T iPhone is still being paid off on an installment plan and you haven’t settled your final balance, there are some serious considerations you’ll need to make regarding potential costs and consequences.

Here’s the main problem:

AT&T has specific requirements for trading in devices that are still in an installment payment plan that many people don’t realize until after they initiate the trade-in process. Because AT&T technically still owns the phone you’re paying for until you complete your final payment, the restrictions and fees you can face on trading in a phone you don’t fully own financially and physically can be quite frustrating.

But there’s more…

As previously mentioned, you’re also likely to still be responsible for paying off the original device balance in the event you trade in, and this can mean losing a significant amount of money. What good is a trade-in offer from AT&T if you still have to pay off the rest of your balance? You just don’t make up that value in the end.

Looking to get the most value for your iPhone trade-in AT&T, even if it isn’t paid off? BankMyCell can help you compare buyback offers from trusted stores that accept financed devices with low trade-in value from your wireless carrier.

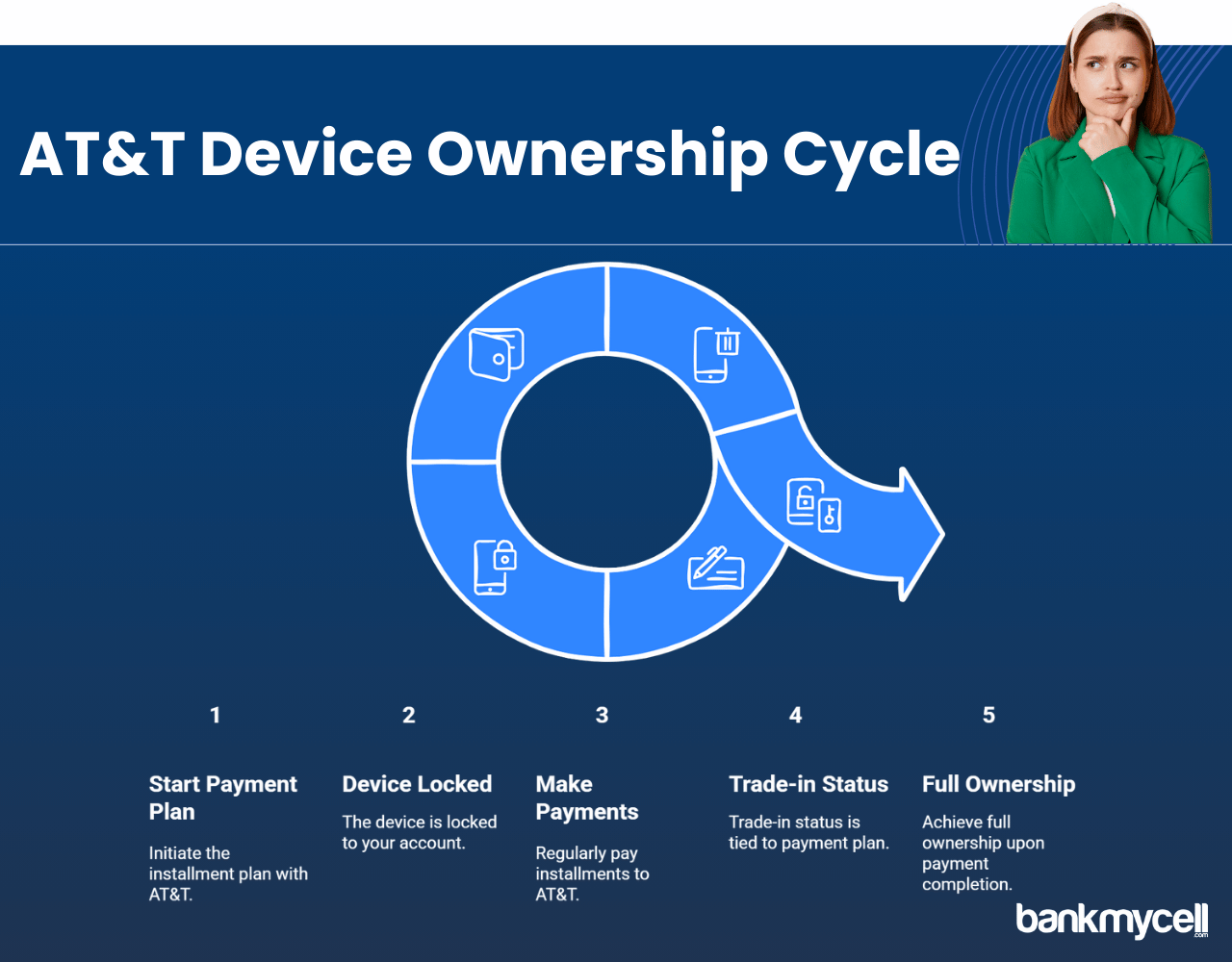

Understanding AT&T's Installment Plans and Trade-In Value Policies

If you don’t know how AT&T’s device installment plans and financing work, it’s going to be more difficult to understand your estimated trade-in value.

AT&T offers customers the option to buy new devices on an installment plan as an alternative to full upfront payments or high-interest-rate store credit cards.

Financing a new iPhone or Samsung device means you pay a fixed amount monthly over a pre-determined number of months (typically between 24 and 36) for that device. You aren’t entirely free and clear of any financial obligations to the retailer until you make the final payment.

This has three important effects:

- You don’t own the iPhone or Samsung device in the full sense until it is paid off

- The device is locked to your account and payment status

- Trade-in status for your device is tied to AT&T and payment plan agreements

Don’t forget:

You don’t just hand over a car to a bank and take the keys for a new one before your loan is paid off, do you? So why would you expect to be able to trade in a financed phone so easily?

Fortunately for AT&T customers, it is technically possible to upgrade early before paying off your device. AT&T also offers promotional trade-in deals during the year.

The next section covers how AT&T Next Up early trade-ins work in more detail. The trade-in value you’ll be eligible for will always be lower with AT&T versus a private sale.

Ready to find out more about AT&T and trade-in value? BankMyCell compares buyback offers from reliable stores that accept phones from any carrier, including those that still owe money.

AT&T Next Up: iPhone and Samsung Trade-In Early Upgrade Program

AT&T’s Next Up feature is the early upgrade and frequent trade-in program that’s tailor-made for customers who don’t want to wait for their monthly payments to finish before they start enjoying a new iPhone or Samsung.

AT&T Next Up is a trade-in upgrade plan add-on that costs $5 per month. Customers who take this add-on benefit get to:

- Trade in and upgrade their device after paying off 50% of the cost of the new device

- Turn in their current device in “good working condition” to AT&T’s trade-in program (screen, battery, functionality-wise)

- The remaining balance of their original phone is “forgiven”

- Begin paying on a new installment plan for a new device

The qualification process to determine your eligibility for the AT&T Next Up program is as follows:

- Next Up must be added to your installment plan

- Your account must be in good standing with AT&T and your payment history must reflect regular payments

- The Next Up program only takes effect when you’ve paid at least 50% of your device cost

- Your iPhone or Samsung device must still be in working condition when you turn it in to AT&T. AT&T’s trade-in program will not accept broken devices with screen damage, poor battery performance, or otherwise.

AT&T Next Up is only available for certain iPhone and Samsung devices (Galaxy S series and Note models) and specific device payment plans.

AT&T’s older Next or Upgrade or Get More programs still exist and follow the same general upgrade trade-in logic outlined in the previous section.

Your AT&T iPhone trade-in options without Next Up

If you don’t have Next Up, you have the following basic options for upgrading early and trading in your device:

- Pay off the remaining balance on your current iPhone or Samsung device in full

- Purchase a new device outright and continue making payments on your old device (running two installment plans)

- Trade in your current iPhone or Samsung to AT&T for trade-in credit you can use towards a new purchase. Warning: you will be responsible for the balance remaining on your old phone at the end of the day

Without Next Up, you can technically trade in a phone that isn’t paid off AT&T but still owe the balance at the end of the day.

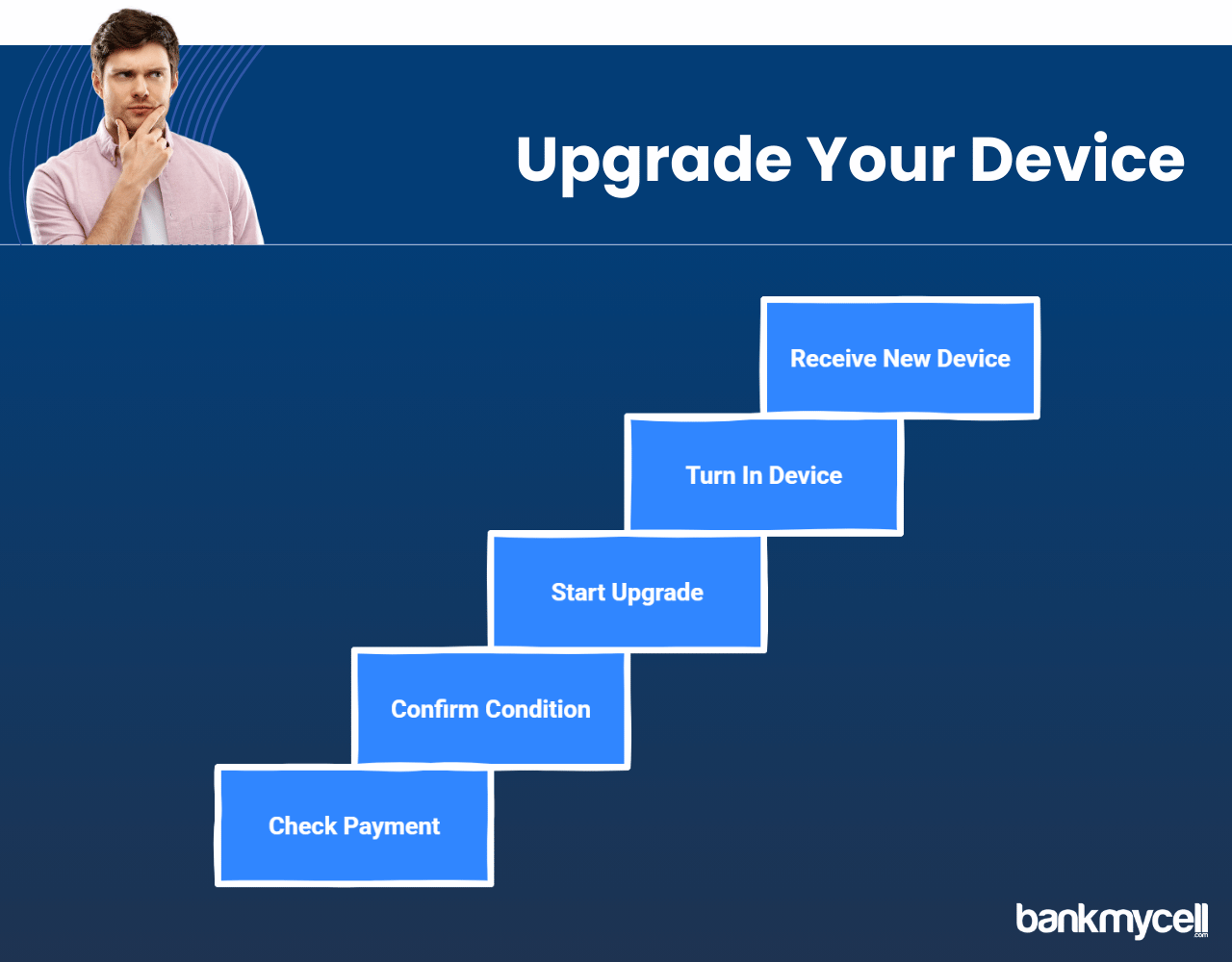

How to Trade In a Financed AT&T iPhone or Samsung: The Process

If you have decided to trade in your device to AT&T through the carrier’s official channel, the process is straightforward.

Trade-in process for AT&T Next Up customers:

- Check that you have paid 50% or more of your device’s cost through myAT&T online or the mobile app

- Confirm your device meets AT&T’s condition guidelines for trade-in status (phone turns on, screen undamaged, battery life)

- Go to an AT&T store or AT&T.com to start the upgrade process. Pick your new iPhone or Samsung model

- Turn in your old device to AT&T in person or by mail within 14-30 days, depending on your location

- Receive your new device and begin a new installment plan to pay off your new AT&T device and recycle your old one

Trade-in process for standard installment plan customers

- Pay off your AT&T iPhone or Samsung device before starting the upgrade process. Make a payment that completes your plan or continue making payments until your balance is paid in full

- Check your trade-in estimate before starting the process at AT&T

- Complete the trade-in at your local AT&T store or online through the myAT&T portal.

- Trade in value is applied to your bill in monthly credits, not a one-time lump sum deposit to your bank account

Advantages to trade-ins through AT&T:

- Convenience of using a one-stop-shop for everything related to your account

- Sign-up promotions that may offer a decent trade-in for your current device

- Ease of device recycling for customers that don’t care about trading in phones for the highest possible amount

Important to note is that trade-in values through AT&T have always been lower than trade-in values you can expect from a third-party buyback or private sale.

The difference may not be too significant when promotions are running. The difference in trade-in estimate can add up to several hundred dollars when it’s not.

Ready to start checking out trade-in programs that might give you better trade-in value than AT&T’s? BankMyCell can help you compare trade-in offers from trustworthy stores that take your device type and can pay you upfront when you sell your AT&T iPhone.

Financial Implications of Trading In a Phone That Isn't Paid Off AT&T

Trading in a phone that isn’t paid off AT&T has several direct financial impacts and implications that are worth understanding.

Remaining balance on your device

The most critical detail to take away from AT&T trade-in policies is that your remaining balance is your responsibility no matter what happens in the trade-in process.

AT&T Next Up is the most prominent exception. Without Next Up, you can typically trade in an iPhone to AT&T and be responsible for the remainder of your balance as a long-term payment against your account. AT&T’s standard trade-in policy for new devices is a $300 bill credit that is applied over time (think 24-36 months).

TL;DR: You will either owe your remaining balance, the cost of your new device, or both at the end of the day.

How the remaining balance can play out in a trade-in

Example: you have an iPhone 13 Pro still being paid off on an installment plan and have $500 left to pay to AT&T. You get an offer for your iPhone 13 Pro of $300. Without Next Up, you can take the trade-in, still owe the $500 remaining on your old phone, and will be paying the full cost of your new phone on a new installment plan. AT&T will immediately apply that $300 as bill credits on your account.

The difference between what you’ll owe and what you get from AT&T in credit is immediately apparent and substantial.

Potential hidden fees when you trade in

It is also important to be wary of any potential additional fees or costs that you may not consider when trading in your device to AT&T:

- Early upgrade fees, if applicable, when switching devices

- Activation fees with your new device purchase from AT&T

- Condition-related devaluation if your phone has screen damage

- Trade-in processing fees that may be applied before you get your trade-in credit

Ask for a complete breakdown of all the costs and credits when you trade in your device. This will help protect your finances from unexpected differences in trade-in value estimates.

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

Alternative Ways to Trade In AT&T iPhones and Samsung Devices

If you are not sold on trading your device through AT&T, there are other ways to upgrade your phone. Let’s take a look.

Buyback stores and trade-in services

Many buyback stores purchase AT&T-financed phones as long as the person trading in the device can show proof of ownership and pay off the balance of the original device (proof of payment before AT&T shipping). Buyback store trade-ins can be a fantastic option for people who need cash on hand immediately for some of these reasons:

- Buyback trade-in values are generally higher than carrier trade-in offers

- You receive payment in cash (lump sum deposit into your bank account) rather than bill credits over time with a carrier

- Buyback services offer more flexibility in how you use the money after you sell your old device

Drawbacks:

- You must still pay off the remaining balance on your AT&T installment plan

- The device remains tied to your AT&T account until your final payment

- If you stop making monthly payments to AT&T for some reason, the device will be blacklisted and unusable for the new owner

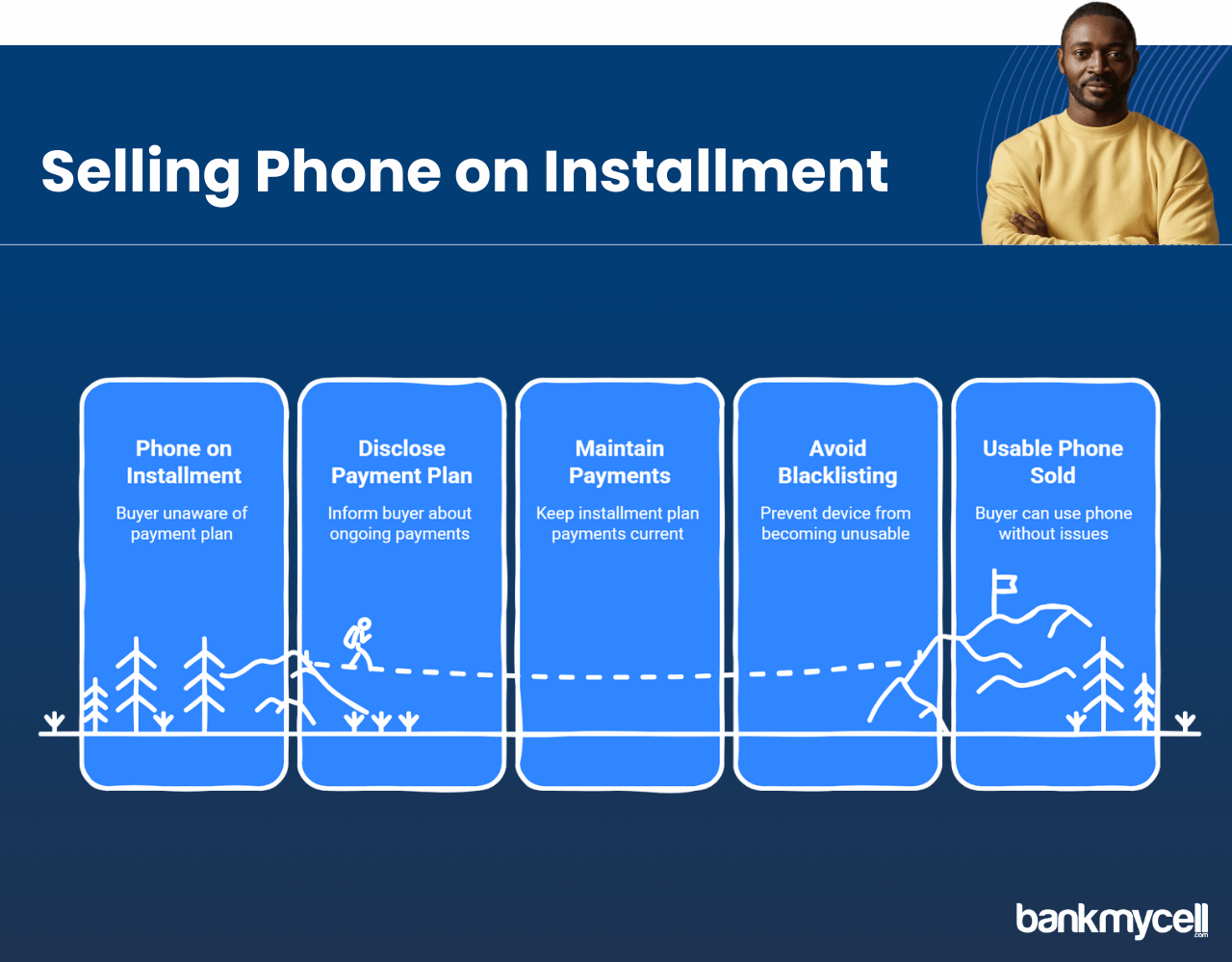

Sell your device privately

You can sell your AT&T-financed iPhone or Samsung directly to another person or dealer. For some, this is the best method, even if you’re worried about a lengthy sales process. This is the only way to take full advantage of the residual value of your device.

Caution is the name of the game here, though. When you sell your device privately, you must:

- Be up-front with the buyer that the phone is on an installment plan and currently being paid off

- Make sure you remain current on your payments for the installment plan, or the phone is unusable by the buyer (dealer or not)

- You could face legal issues down the road if the device gets blacklisted or unusable in the second owner’s hands

Upgrade and continue your payments on your old device

Sometimes the best solution is the simplest:

- Keep your current AT&T iPhone as a backup or primary device

- Continue making your monthly payments on it as per your contract

- Purchase a new iPhone or Samsung model either as a direct purchase or on a new installment plan

This avoids potential headaches with dealing with trade-in policies that may cause headaches with your financed device. It does mean you’ll be paying for two devices while only actively using one.

The Upsides to Waiting Until You're Done Paying Off Your Device

The last option above might seem like the most glaringly obvious and safe approach to the issue of trading in a device you still owe money on AT&T. After all, if you have to pay it anyway, why trade it in?

In addition to waiting off the hook on any remaining balance questions when you upgrade or purchase a new device, you can also expect to see an increase in your trade-in value when your phone is no longer tied to an installment plan and any balance associated with it.

Sell directly to AT&T by upgrading with the Next Up program

Using AT&T’s Next Up trade-in program is a good choice for some. Why? Because your trade-in value will be higher since you don’t have to worry about the remaining balance and related implications.

Your new trade-in with AT&T is dependent on two factors:

- The actual cost of your new device and what AT&T is charging for their store credit at the time of trade-in

- The condition of your old phone (device health)

Condition will make or break your AT&T upgrade. AT&T has a slightly different definition of “good condition” when it comes to phones still being paid off:

- Phone powers on and is responsive

- The screen is intact (no cracks or shattered glass)

- The battery is functional and does not drain excessively

- The phone must not be blacklisted or marked unusable in any database

Disclaimer: You can sell financed iPhones, but you are still responsible for the finance payments. The sale does not end your responsibility to continue your contract payments. Always check your carrier’s terms if you are not clear.

frequently asked questions

Will I be able to trade in my iPhone to AT&T and not owe the remaining balance?

Unless you’re a Next Up customer, you are going to remain responsible for the remaining balance of your AT&T device at the end of the day.

Can I still upgrade early with AT&T and not have Next Up?

Yes, but you’ll have to pay the full balance off on your current device first. The alternative to Next Up (upgrading early) has you pay for your new device and continue paying on the old one simultaneously. No trade-in value involved.

What will happen to the person who buys my AT&T phone if I default on my payments?

AT&T will place a “blacklist” (aka blacklist) on your phone. This blacklist is a database of problematic devices shared between carriers and other phone vendors. A blacklisted device can end up being a very expensive surprise for the new owner.

Can AT&T tell if I trade in an iPhone they still own?

Yes, AT&T’s system checks this automatically.

Can I upgrade to another carrier like T-Mobile with my AT&T iPhone still owing a balance?

Yes, as long as you continue making monthly payments on it. AT&T phones may or may not work on T-Mobile and other networks (read more about this in our guide on T-Mobile vs. AT&T vs. Verizon.) Your monthly payments don’t go away when you upgrade or switch carriers.

Wrapping it Up

Trading in a device that isn’t paid off AT&T can be difficult, depending on your reasons for trading in and your situation with your old device. AT&T’s Next Up program provides more than enough options for most of our readers looking to upgrade their devices early before paying them off.

In order to make the best decision about your AT&T trade-in, we recommend you:

- Assess your situation by using AT&T’s next up decision process (can you afford to upgrade? Do you want to upgrade early?)

- Get a quote for your device from a trusted buyback store that will pay cash for your device and will accept it for trade-in, even if it’s not paid off

- Compare that buyback offer to the carrier trade-in you get from AT&T. Consider whether the convenience of a single carrier is worth the difference in cash for you.

- Choose your option and move forward, remembering to compare offers from third-party stores to AT&T at least twice a year if you decide not to upgrade immediately.